As part of our data collection exercise, we are gradually adding more data. This time it has come to daily hedge fund data, collected from UCITS or 40 act vehicles. This is still in development and we hope to have a full dataset available before the year-end.

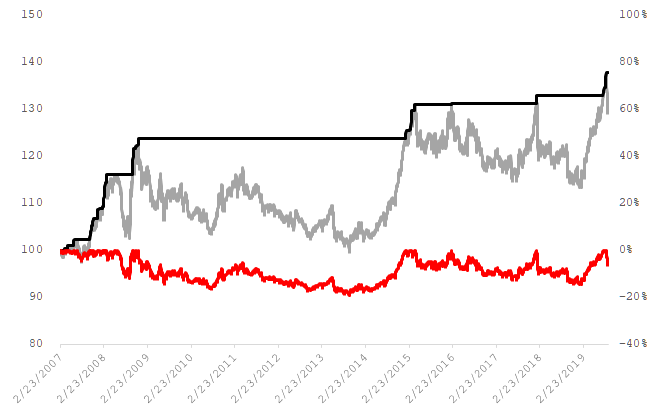

From this preliminary summary of funds with managed futures classification, we note that the new highs were set in August, but that the start of September has been a bit bumpy. Preliminary, this setback is approximately 5%, which still results in a 13% gain for the year. The risk (here standard deviation) of the index is 8%, so CTAs have delivered close to a two sigma year.

Given the pain arbitrage nature of trend trading, we casually note that the index has been on highs approximately 3% of the days since 2007.

Sign up for the underlying database and a user account here (free).

Getting better all the time 🙂