Nilsson Hedge provides a free CTA/Managed Futures and Hedge Fund database. The vast majority of the database covers CTA or Managed Futures Managers, using a variety of styles and strategies. In addition, NilssonHedge offers supplemental coverage of a number of Long/Short Equity Managers, Fixed Income Strategy, and Multi Strategy hedge funds.

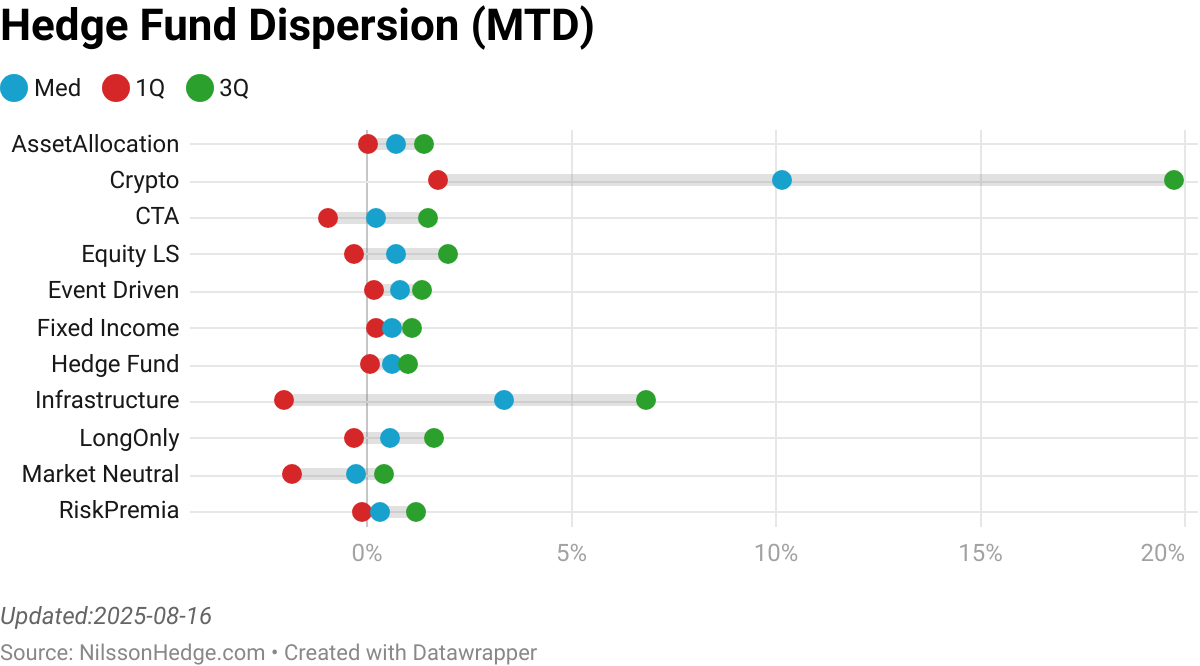

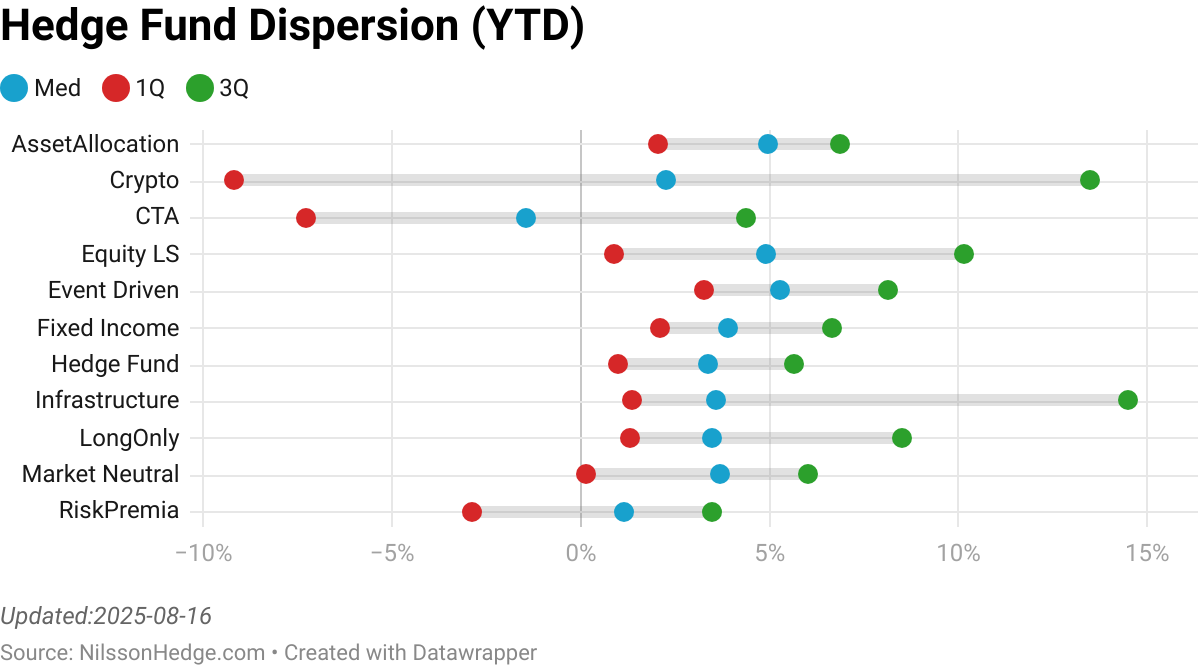

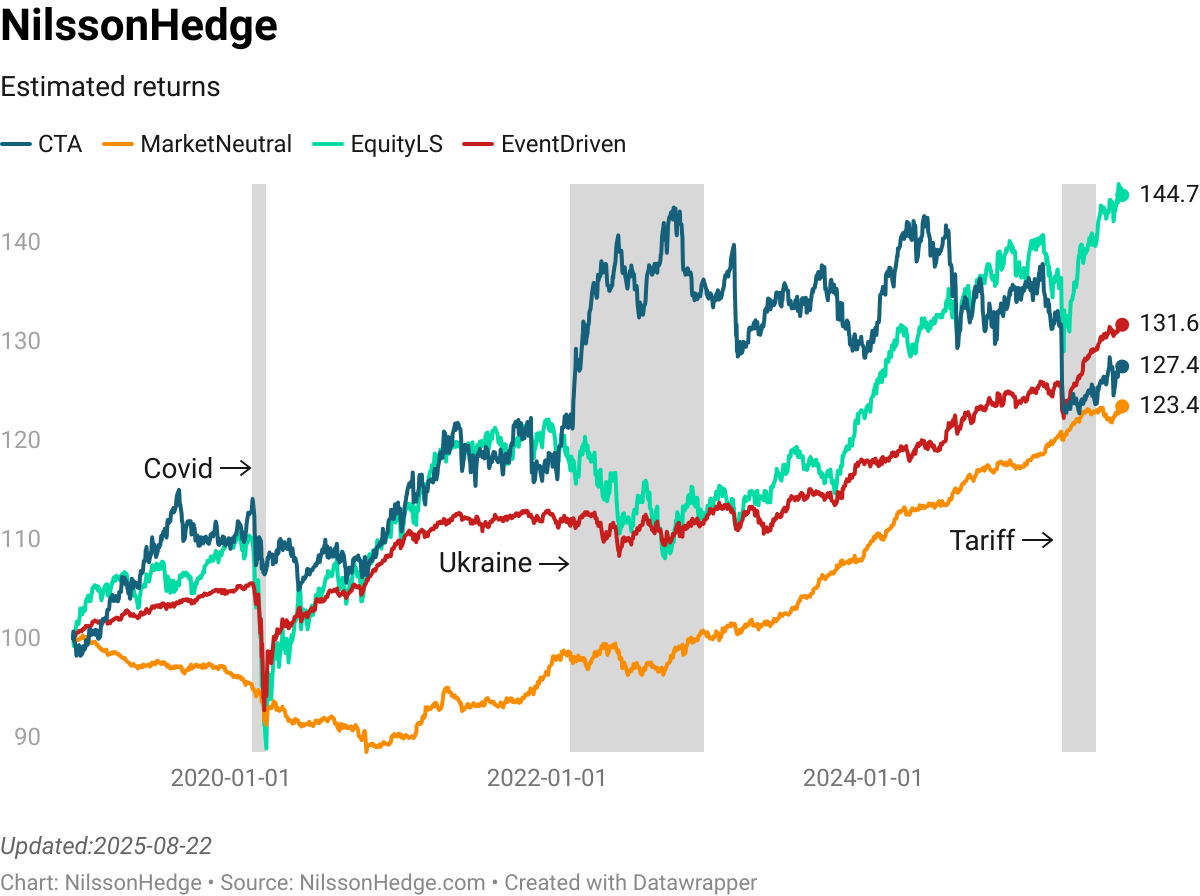

The estimated MTD performance for Hedge Funds (including Crypto Trading Strategies) is 3.6% taking the YTD number to 18.9%. The estimated MTD performance for Hedge Funds (excluding Crypto Trading Strategies) is 2.3% taking the YTD number to 6.6%. The estimated MTD performance for CTAs is 2.7% taking the YTD number to 8.2%. We note that this is an estimate for reporting funds and that better performing funds typically report early. These estimates do not include funds that have stopped reporting. For the survivorship adjusted number, we would like to direct you to the NilssonHedge indices at https://nilssonhedge.com/index/.

Explore our free overview of Hedge Fund performance at https://nilssonhedge.com/reports/nilsson-report/

Sign up for the database here: https://nilssonhedge.com/database-info/databaseinfo/database/register-for-access-to-the-database/

The Database contains 2033 different managers, representing 3776 different investment strategies. For the current reporting month, 1558 managers have reported returns. For the prior month, we have 1749 live managers. In terms of CTAs, for the current reporting month, 562 CTA programs have reported returns. For the prior month, we have 701 live programs. In total, the database contains 26908 years of manager data. We cover 389 bn of Assets in the Hedge Fund space. Out of which 203 bn of Assets in CTA/Managed Futures managers.

Over the last three calendar months, we have added 307 new strategies to the database.

Database overview, including graveyard: Number of CTA Strategies: 2424 Number of Equity Long Short Strategies: 339 Number of Market Neutral Strategies: 109 Number of Event Driven Strategies: 52 Number of Fixed Income Strategies: 135 Number of Crypto Strategies: 197 Number of Asset Allocation Strategies: 161 Number of Risk Premia Strategies: 48

To view estimates of current performance, our daily indices provides unique insights (https://nilssonhedge.com/index/daily-indices/)

This text is auto-generated and may contain mistakes. Past performance is not indicative of future results

NilssonHedge is a free resource, but we would appreciate a small donation that will be used to maintain the site.