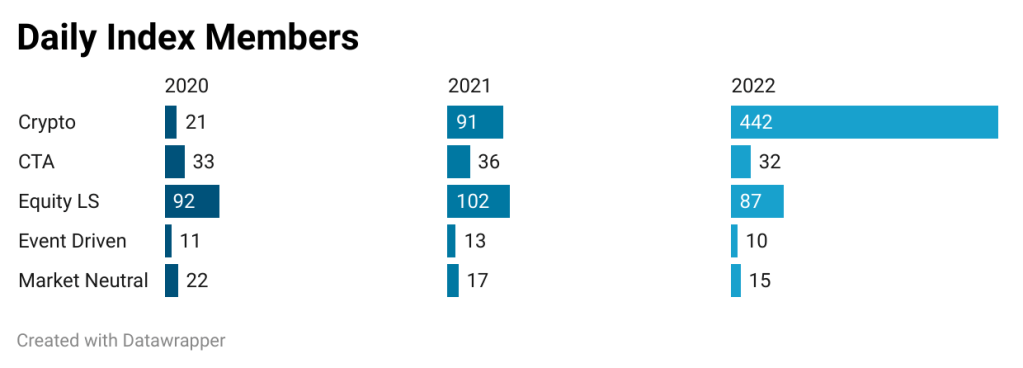

As part of our unique service offering, we are providing sophisticated investors with several performance barometers. For five different markets, we are calculating daily indices (CTA, Crypto, Equity Long/Short, Event-Driven, and Market Neutral strategies), which are providing an instantaneous read on how managers are performing. As per the 1st of January, the indices were reconstituted and a new cohort of managers are now constituents.

We note that there has been exponential growth in terms of Crypto Managers, partly this is driven by how we source constituents but also reflects the growing interest in Digital Assets. For CTAs, the number of managers is nearly the same. We note a decline in the number of Liquid Alternative managers providing Equity Market Neutral exposure. Given that performance has picked up for Market Neutral strategies, this does perhaps reflect that the strategy is less crowded than it used to be. Equity Long/Short strategies remain the most common strategy from a traditional financial perspective.

The daily indices can be found here: https://nilssonhedge.com/index/daily-indices/. Statistical tracking of current betas and correlation can be found here: https://nilssonhedge.com/reports/hedge-fund-correlation-and-beta/.

CTA Index constituents: https://nilssonhedge.com/index/daily-indices/daily-cta-index/daily-cta-index-constituents/

Crypto Index constituents: https://nilssonhedge.com/index/daily-indices/daily-crypto-index/daily-crypto-index-constituents/

Equity Long/Short constituents: https://nilssonhedge.com/index/daily-indices/daily-equity-ls-index/daily-equity-long-short-constituents/

Event-Driven constituents: https://nilssonhedge.com/index/daily-indices/daily-event-driven-index/daily-event-driven-constituents/

Market Neutral constituents: https://nilssonhedge.com/index/daily-indices/daily-equity-market-neutral-index/daily-equity-market-neutral-constituents/

At the end of January, we will publish index constituents for the monthly indices.

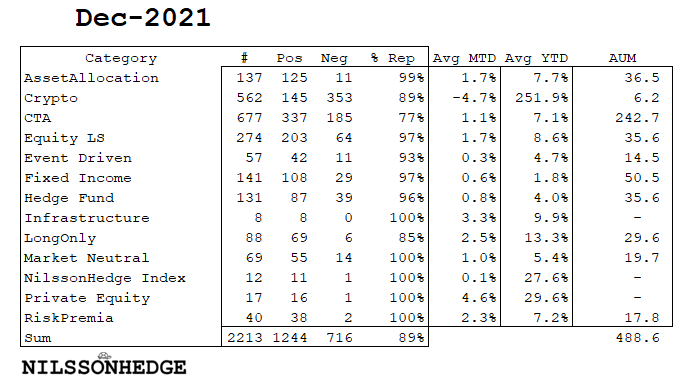

In other news, we have updated the databases, and we now have coverage of 1965 funds that have reported returns for the full year of 2021.