As the FED delivered its second triple hike in a row, and we saw a second negative quarterly GDP print, markets decided that recession was to be pronounced rɪsk ɒn ˈsɛʃən [risk on session]. To the relief of equity related strategies and to the dismay of macro strategies, markets staggered a rally, in anticipation of a less aggressive tightening.

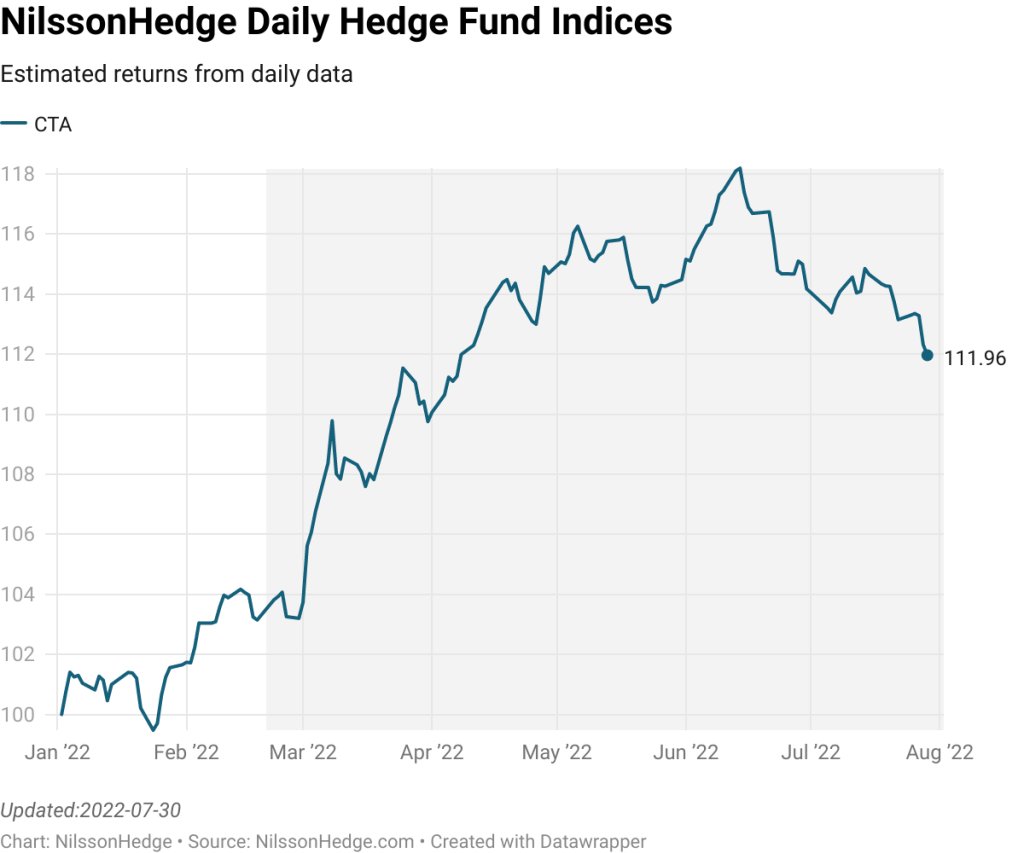

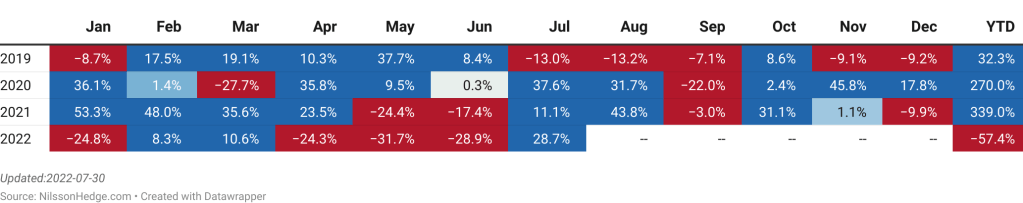

On a preliminary basis, judging by the NilssonHedge Daily Performance Barometers, CTA lost 1.9% for relatively low volatility programs. Equity Long/Short, a strategy heavily dependent on equity market directionality, gained 2.3%. Event-Driven strategies, less sensitive to Equity Markets but yet sensitive gained 1.2%. Market Neutral hedge funds struggled and had a flat month. And the strategy that has one of the highest beta to risk-on/risk-off markets, Crypto Trading recovered a whopping 28%.

As markets have re-entered risk-on territory, CTAs moderated their short-positions in equities (and may not be flattish). They remain short bonds and long the US Dollar.