Equity Market Neutral is a strategy that seeks to remove exposure to the general equity market through hedging the primary beta and correlation risk. It has large similarities to equity long/short strategies, but with most of the equity beta removed through the trading of pure relative value strategies between individual securities. Some managers neutralize sector exposure and sometimes even specific factor exposures to keep selected exposures low (momentum, quality, value, etc.).

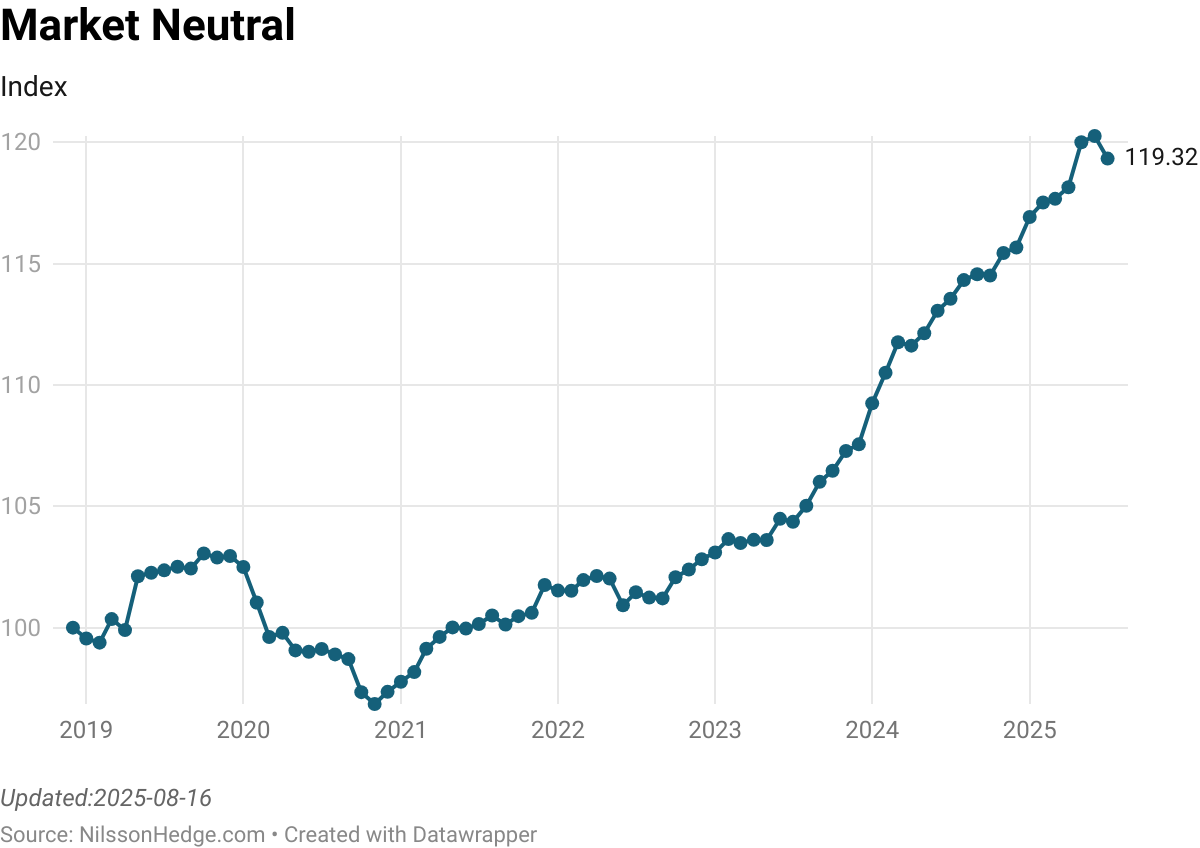

NilssonHedge provides two different performance barometers: A daily index and a monthly index. Most of the data in the monthly index represent UCITS funds while the daily index primarily reflects US 40-act funds.

The style can be described as a modification, and potentially a purer version, of the ordinary Long/Short Equity strategy, but where the focus is also centered on neutralizing the equity market premia to extract stock-selection alpha. As such, the strategy does generally not benefit from the positive drift in equity markets and will need to earn its keep from stock-picking alpha. Adding to this, market-neutral trades typically have low volatility and to achieve acceptable returns, the portfolio typically needs leverage, 3xLongs by 3xShort is not uncommon, but leverage depends on structure and trading frequency.

The additional leverage creates a dependency on prime brokers, being able to borrow and will generally be dragged down by costs. Market neutral strategies exist outside equity markets, but are rarely classified as Market Neutral, but rather as relative value.

Market neutrality can be defined in a number of different manners:

- Dollar Neutrality – Every dollar invested in a long position is offset via a short position, with the same underlying value. This may leave residual beta risk in the portfolio and cause a positive or negative correlation with markets. This is typically the way factors are constructed

- Beta Neutrality – Statistical hedging of the estimated beta risk for the portfolio. In contrast to the Dollar Neutrality strategy, this leaves the portfolio open to estimation risk or regime changes for particular stocks.

- Factor Neutrality – To avoid being mapped as a risk premia strategy, some strategies try to further isolate stock picking alpha by removing any obvious factor exposure to well-known equity market factors.

Using the NilssonHedge Equity Market Index we observe that beta is low against US Stock Markets, but that the correlation is somewhat variable. This is compatible with the observation that most of the managers are seeking to hedge out market risk, but not necessarily sector and factor risks.

Different Styles

Discretionary

This is the strategy that most resembles the Long/Short Equity strategy, pairs-trading, trying to remove as much of the Beta as possible through having longs and shorts in the same sector/factor/country, etc. Here, the manager is mandated to extract alpha from the selection of securities rather than catching the drift in the underlying markets. This strategy typically does not rely on a Factor-based strategy, but rather on trading convergence or divergence in selected pairs based on fundamental analysis. These portfolios are typically also more concentrated than their fully quantitative peers.

Factor Strategies

A factor-based strategy is, to keep it simple, a strategy that divides the equity market universe into parts and invests in the highest-ranked part, and sells the lowest-ranked part. The sorted portfolio describes a return series that is not expected to be related to the underlying equity market, but rather derive returns from some market inefficiency. The approach has been historically popular with academics, but also with index providers. Some of the factors have made it into market-neutral hedge funds.

Factors have historically been one of the more popular ways to access equity market-neutral strategies. While starting with relatively simple strategies, such as Value and Size (Fama-French), the sectors have exploded in a zoo of factors and researchers are finding interesting anomalies all over the place. However, this search has in some cases been accused of false discoveries and some of the factors may not survive out of the sample. For an article discussing the Factor Zoo, see Campbell Harvey’s “a census of the factor zoo“.

The Value factor has had a large negative impact on most factor based strategies. As one of the most coveted, high capacity, low turnover strategies, it has suffered a large drawdown. Using the Fama-French Value factor (HML factor), a market-neutral strategy, we note that the factor is now a 100-year maximum drawdown, not even rivaled by the IT rally in the late 1990s or the Great Depression (the data is available from the Kenneth French data library).

Statistical Arbitrage

Stat Arb is a flavor of quantitative equity market neutral strategies, where the trading frequency is typically higher than for factor-based strategies. In most cases, these strategies seek to exploit mean-reversion between securities in a portfolio. This strategy was partly behind the ‘quant crash‘ in 2007 which was partly explained by rapid unwinding on crowded positions, pulled bank credits, and generally more difficult financing conditions.

Reasons to Allocate

Market Neutral belongs in a bucket that seeks to generate returns with a low beta to the equity market. Thus, it can be an effective diversifier in a portfolio that is dominated by equity market risk. Returns have been on the lower side recently, partly because of the poor performance from Value, but also a general crowding to Alternative Risk Premia Factor that has been popular in the strategy, and we see a relatively high turnover of managers in the sector.

You must be logged in to post a comment.