CTAs or Managed Futures Hedge Funds is a particular strategy within the Hedge Fund universe, a strategy that has its specific regulator, tax treatment, and is generally perceived to be positively skewed. Often, but far from always, the strategy is largely perceived to be synonymous with Trend Following strategies. That said, the managers are diverse and exhibit a range of characteristics. Managed Futures is almost always a trading-oriented strategy, where the profits originate from being able to correctly predict the markets, exploit risk premia, or other anomalies.

Formally the NFA defines that a “commodity trading advisor (CTA) is an individual or organization that, for compensation or profit, advises others, directly or indirectly, as to the value of or the advisability of trading futures contracts, options on futures, retail off-exchange forex contracts or swaps. All registered CTAs who manage or exercise discretion over customer accounts must be NFA Members. CFTC Regulation 4.14 details the criteria that must be met for exemption from CTA registration, including:

- The advice was provided to 15 or fewer persons during the past 12 months and the entity does not generally hold itself out to the public as a CTA; or

- The entity is CFTC registered and advice is solely incidental to its business or profession; or

- Advice is provided that is not based upon knowledge of or tailored to a customer’s particular trading account or trading activity.”

To track the number of managers registered as CTA, we have developed a dashboard. Noteworthy is a CTA does not need to trade Commodity Futures markets, but can trade in currencies, equities, and fixed income futures. The name refers to the definition of “Commodity Interest” referring to (any) futures, forex, and/or swaps.

Instruments

Often a CTA only trades liquid, exchange-listed instruments Futures and Forwards (FX/Metals) and offers better liquidity to the end investors compared to your typical Hedge Fund. In several cases, Managed Futures managers have daily or monthly liquidity or can be accessed through a managed account with full access to positions (for a given account size). Pricing is of the underlying instruments is transparent and can be found on the websites of the exchanges.

A large number of UCITS or 40-act funds offers easy access to large managers. Depending on the fund specifics, these may be accessed by retail or institutional investors. Furthermore, conditional upon the jurisdiction the fund is available in, it may be allowed to only trade specific instruments, require structuring, or could be subject to regulatory restrictions. In many cases, UCITS funds are not allowed to trade Commodity markets, but will typically use swaps to gain exposure to such markets.

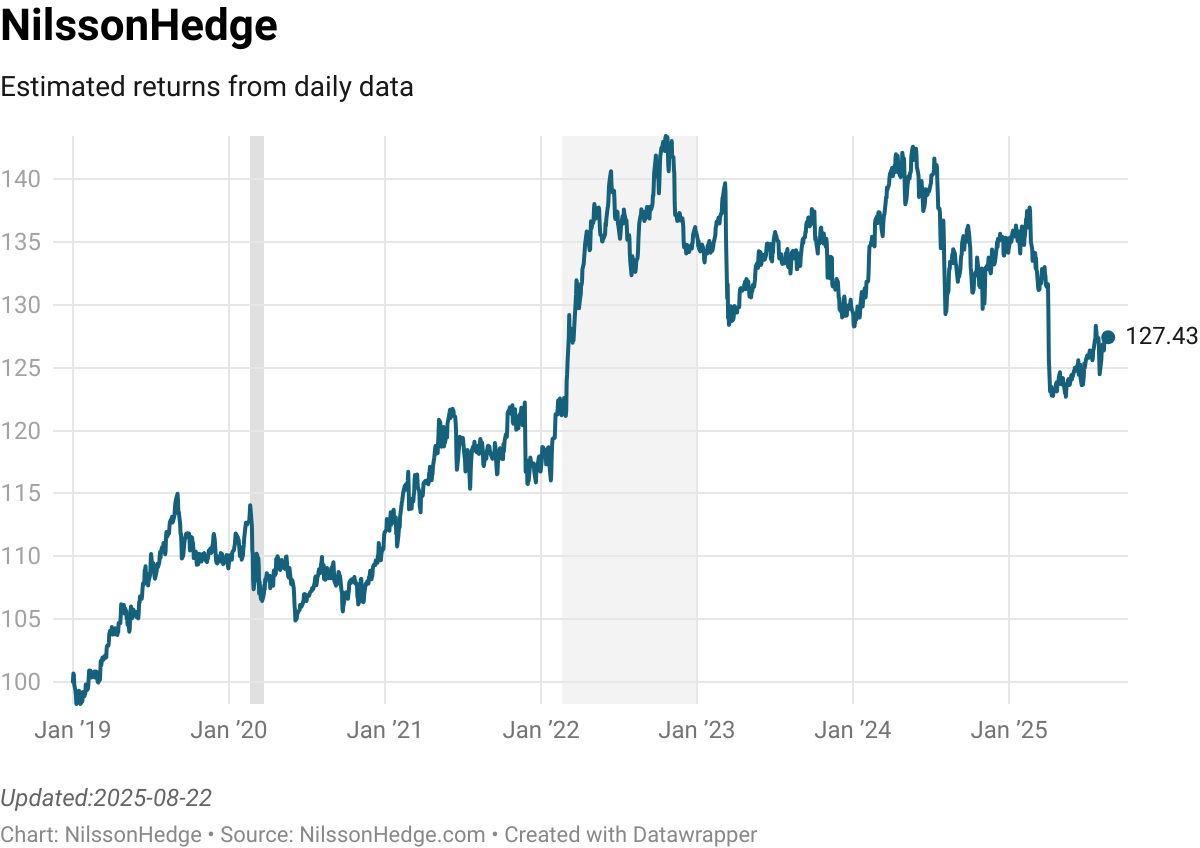

NilssonHedge maintains a daily CTA index, largely sourced from Daily Funds. This indicator can be used to gain insights into correlation, general performance but also for benchmarking your own strategies or portfolios. Daily data is available for free. We also maintain a number of CTA indices (Main, Systematic, Discretionary)

Macro Managers, that are trading in the liquid markets are often trading a slightly different instrument space, including options, occasionally OTC instruments but are in our database classified as a CTA, despite not always being strictly correct. Another difference is that Macro Managers tend to be more discretionary than systematic. To make things a bit complex, there exists a large number of systematic macro managers that only trade Futures, and it’s generally difficult to always distinguish between the two styles. Our database classifies both strategies as CTAs but offers additional classifieds such as Discretionary / Systematic or Fundamental / Trend Following as an indicator that a manager may be more of a traditional Macro manager rather than a Systematic Futures manager.

Reasons to allocate

Managed Futures managers, or in particular, trend following managers have over the last ten years underwhelmed on the performance side, with several of the large managers having nearly flat performance over the last decade. So, why are institutions still allocating to this space? We will explore two of the most common reasons: tail protection and positive skewness. Both of these are positive characteristics, often leading to uncorrelated behavior during market stress. One of them is the characteristics of a particular feature of Trend Following, whereas the other is something that is observed from return data and correlation to markets.

Skewness

Skewness is a statistical measure to describe the behavior of the tails compared to the average return. CTAs and in particular trend following strategies are viewed as a positively skewed strategy, with greater positive returns compared to the average. As the general Hedge Fund is largely negatively skewed, a strategy with positive skew creates a better and more robust hedge fund portfolio.

Positively skewed returns, in simplified notion, comes from being able to add to winning positions (or add to correlated markets) or as argued occasionally, from the use of stop-losses. In the former case, this will generally amplify the upside if markets continue to trend. In the latter case, the stop-losses are effectively cutting off the left side of the distribution without affecting the right side of the return distribution. That said, the skewness of a trend following strategy is largely a function of the return distribution of the underlying markets and unless adding to a market, or using stop losses, skewness will not appear out of limbo. The positive skewness comes with a cost, as stop-losses are often costly to use, and adding to a position may come with the additional risk of losses if markets turn abruptly.

Using the NilssonHedge CTA database, we find that the higher the risk (measured as standard deviation), the more positive skew we observe. While this sample may be biased by survivorship bias and the fact that large positive returns will increase standard deviation, this is a result that rhymes well with the expected characteristics of trend following strategies.

Tail Risk Protection

Tail risk protection refers to the nifty, historical capability of CTAs to provide positive returns in equity market stress periods, offsetting equity market losses. This is clearly a beneficial strategy characteristic.

To demonstrate the phenomenon, we construct an index of the CTA from managers with long track records and compare their performance to equity markets. We find that these managers have been able to provide positive returns during large equity market moves, both up and down. This is relatively rare within hedge funds, as most hedge funds have some residual correlation with equity markets and tend to exhibit a positive correlation in equity market stress (i.e. equity losses and losses in your hedge fund portfolio). We also note that this index is hypothetical and should be construed as investment advice, only an illustration of how a set group of surviving managers has been able to navigate equity market stress periods.

However, during the last few years, CTAs have not been able to offset large negative equity moves. Experts point to different factors: Style drift, less trend following exposure, V-shaped recoveries, Central bank interventions, etc. Most likely it also relates to the behavior of fixed income markets that have exhibited less strong trends.

As seen, CTAs have a time-varying correlation with Equity markets (and most other markets), but in upward trending equity markets, the correlation will be positive, as trend strategies will be long equity beta. Thus, in a long-term bull market, the protective power of CTAs is diminished. Moreover, the anti-correlated properties are worse if the strategy is short-duration risk at the same time.

Common Strategies

It has been shown that aggregated CTA returns can be explained by so-called trend-following rules, i.e. strategies that buy market strength and sell market weakness. There are a number of articles that explain how CTAs can be replicated and what kind of considerations need to be taken. Typically a CTA is relatively slow, often taking weeks or months to turn a position around. However, there is also a large number of other strategies. NilssonHedge has a number of strategy classifications for CTA (here) that can be used to gain further understanding.

- AI – Managers using artificial intelligence or machine learning to extract signals from markets. Sometimes, this is also called pattern recognition or similar terms. But pattern recognition may not always be an AI technology, in those cases, the manager is sorted under a different category.

- Behavioral – Strategies seeking to exploit repetitive behavior from human investors and speculators.

- Contrarian – A manager seeking to predict market turns, trading in an anticipatory way.

- Fundamental – Often, this is also called a systematic macro manager and relies on a broader set of data inputs in addition to price, which is the most common input for the other strategies. In this category, we also find Global Tactical Asset Allocators.

- Market Neutral – A manager that strives to be neutral to the market, often by using intra or inter-market trades. In commodities or fixed income, positions along the curve are often traded. The latter is also called spread traders. This category may also be referred to as Relative Value.

- Multi-Strategy – Managers that are allocating to several strategies, preferably uncorrelated strategies. Typically, this is the classification for strategies that are not “style pure” but rather allocates to a set of different return streams.

- Option-Strategies – Strategies that are using options or volatility-related instruments to express views or strategies in the market.

- Option-Writers – A strategy that sells options, often in an attempt to exploit the volatility premia – the difference between implied and realized volatility. Most commonly this strategy has a catastrophic downside when realized exceeds implied.

- Short Term – Strategies that hold positions for a few days or even intraday. These managers are typically capacity-constrained but can offer uncorrelated return streams.

- Trend Following – the most common strategy in the CTA space, strategies that seek to exploit momentum in markets over various time horizons.

Systematic managers are more common in the CTA space. That does not always mean that they are more successful. Over the last two decades, the Systematic manager represents between 70 and 80% of the assets allocated to the strategy. That is easy to understand given that most of the well-known CTAs are systematic.

Summary

Managed Futures is a liquid investment strategy, often perceived to be tail protective, that has found a place in many portfolios, despite the lackluster performance of late. It has been the poster boy for Systematic Trading, often having nerdy portfolio managers run billions of assets using sophisticated mathematical strategies. For investors looking to learn more about the strategy, NilssonHedge offers access to a large database of managers where you can learn about track records, survivorship, and return patterns.

You must be logged in to post a comment.