Global Investment Report’s survey of the Top 50 hedge funds is unique industry research. This year is the 20th edition of the survey, which previously has been featured in The Wall Street Journal, Barron’s, FinancialTimes, and Institutional Investor. An exceptional feature of the annual survey: it then tracks the subsequent performance of the select 50 funds while discussing evolving macro and industry trends.

Inside this issue:

I had the opportunity to sit down again with Eric Uhlfelder, the author of the report, to discuss his 3rd quarter update. We discussed improving fund returns that outpaced the market during that time, what the peaking of interest rates and tightening bank lending might mean, and the market-topping performance of the Top 50 when looking back over the past two years.

If you want to skip our chat, you can jump directly to his report by opening this link where there are more insights into recent performance. And you can learn more about Eric’s work at Global Investment Report.

The Fed

We seem to be shifting towards a more stable interest rate environment as US rates appear to have peaked. Markets are expecting lower rates in 2024.

Do you think that means the Fed Put is back in business again and should we expect easier trading conditions for larger hedge funds?

I think the Fed support of markets was already demonstrated when it recently decided to keep rates steady even after US GDP growth came in at an astonishing rate of 5% with solid employment numbers. I think its actions had much (but not all) to do with three straight months of market declines, which clipped off more than 8% from the S&P 500.

So everyone was happy to see rates holding steady, but some were mystified that macroeconomic conditions still appear to demand more restrictive monetary policy.

On that front, the Fed is continuing to quietly put upward pressure on rates through its robust quantitative tightening ($75 billion per month), which I believe is a good thing. But over the past month, we’ve seen Treasury yields easing.

If we’ve learned anything over the past 20 years, it’s the need for the government to keep some powder dry for the next crisis. And this segues right into your question: will the Fed ease tightening if markets conditions get dicey?

Save for a market collapse, I don’t think the Fed will cut rates if macro conditions don’t merit it. Taking some air out of the markets is probably a good thing. But when you look at the equally-weighted S&P 500, performance is far more modest, which further confuses matters.

US Elections

Will next year’s US presidential election impact monetary policy?

In theory it shouldn’t because the Fed is independent. That said, I would think the administration would want to get all the support it can muster to help offset the current economic doubts that polls persistently show. Declining 401Ks and rising unemployment are certainly two things Biden doesn’t want to be facing in the summer of 2024.

As for easier trading conditions, I think you’re really asking: will there be more discernable trends for managers to ride? I have no idea. Hedge funds are being paid handsomely for their investment acumen, so frankly I don’t think that should really matter. But we know it does.

Closing the Performance Gap

Reflecting on your 3Q22 update title that references the underperformance of the Top 50 versus the market (“Closing the Gap…Sort of…”), you’re suggesting some doubts about whether hedge funds—even the most consistently-performing ones—can manage through the current uncertainty?

Everyone’s familiar with the adage that the market can stay irrational longer than investors can remain solvent. That’s what many managers are so fearful of because they see the disconnect between what should be happening with soaring rates and geopolitical risks versus the good times a portion of the market is still enjoying. Institutionalization of the hedge fund industry has imbued caution in the way managers are erring.

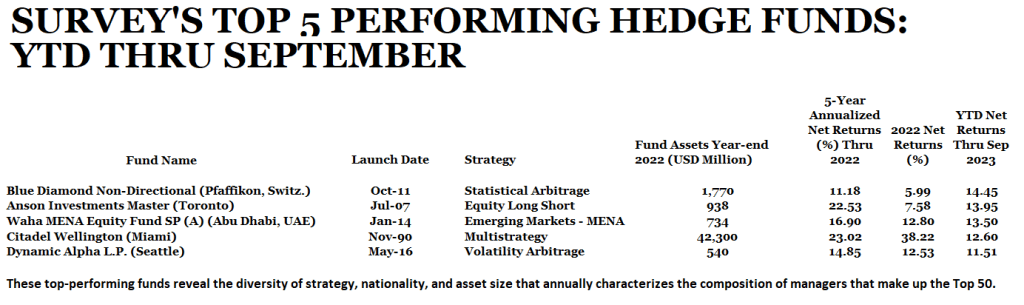

That’s not to say that most of the Top 50 aren’t making money. They are, and some are doing very well (see table below). But on average, not so much. And I’m not sure how as a group this most consistent list of managers can escape the disconnect between what the market is doing and what worries them.

Active Management

Sounds like you’re questioning the merit of active management.

No. Last year, the Top 50 collectively outperformed the market by nearly 24 percentage points. If you add in this year to the calculus, these funds are still outperforming the market over a nearly two-year stretch. (Note: more than two-thirds of last year’s funds made this year’s list.)

That sounds like I’m making an excuse for this year’s performance. Not really. I’m trying to understand it, because selecting time frames for judging performance is always subjective. But it does put this year’s returns into a broader perspective.

Investors pay for active hedge fund management to generate more consistent returns with less volatility. That’s what we’re seeing. In 2022, the Top 50 managers generated average gains of more than 5.25%. They are on track to generate about the same level of returns for 2023.

The S&P lost more than -18% last year and this year through November the market is up more than 20%. So over this two-year period, investors would’ve done better being in the Top 50 instead of the market.

Is a recession around the corner?

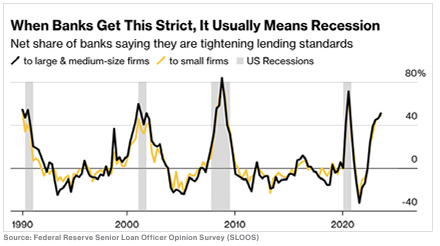

The last chart in the quarterly update indicates banks are significantly tightening lending standards and historically that has foreshadowed recessions. Please explain.

The Bloomberg Chart (above) you’re referencing, which correlates tighter lending standards and recessions since 1990, currently highlights two factors: one, there’s a time lag between when rates sharply change and are then felt in large pieces of the economy; and two, there’s already evidence of rising default rates across the board, led by auto loans and credit cards, with mortgages following suit.

Bloomberg reported in early October that, “The latest reading shows that about half of large and mid-sized banks are imposing tougher criteria for commercial and industrial loans . . . The impact is set to be felt in the fourth quarter of this year and when businesses can’t borrow as easily, it usually leads to weaker investment and hiring.”

One thing that could challenge that forecast is the exponential growth of the shadow banking industry, which includes hedge funds that lend. Since the financial crisis, many non-bank lending entities have done well filling in where banks have left a void. But in the recent past, they weren’t faced with firms needing to refinance cheap money with much more expensive loans. That begs the question: can troubled companies manage with near and at double-digit interest rates?

Opportunities and Risks for Credit Funds

How should hedge fund investors handicap that possibility? Will it provide additional opportunities to credit funds?

The argument smaller fund managers make: they target smaller companies and loans that larger lenders don’t bother with. Their due diligence seeks value in lending when there’s proof of sufficient cash flow to repay short-term loans, typically less than three years. These managers also claim to lend only when they are high up the capital structure, i.e., first in line for payment or well positioned to exploit post-bankruptcy reorg equity.

The real problem for underlying investors is knowing that managers stay within their wheelhouse or will they be tempted by significantly discounted paper and high yields to take on more risk?

How can investors discern the level of risk taking?

It’s not easy. But several things LPs can do is to maintain regular communications with the PM about its lending standards. Ask to see them. Make sure they are indeed maintaining first-lien status and that borrowers’ businesses and financial status are well vetted and understood.

Then ask how often loans are marked to market and what it takes before a declining valuation actually shows up in a fund’s balance sheet? Also ask managers if their pace of loan restructuring and bankruptcies is increasing or stable. These are usually good indicators whether or not they are digging themselves into a hole.

Another telling metric is to see what kind of financial skin the principles of firms doing the borrowing have in their business. And the same goes for your hedge fund managers. The more the better.

This sort of due diligence can help assess risk. But it assuredly doesn’t eliminate it. If you can’t get specific information on these points, that’s not a good sign.

Due Diligence

You stopped reporting on two funds in your list. I understand that this is rather unique. Could you please elaborate?

Correct. This is the first time I’ve stopped reporting on any fund after many years of managing a global hedge fund survey. And the reasons for doing so are highly unusual, not involving liquidity or gating issues.

The Ramius Merger Strategy (47th ranked) was launched more than a decade ago. The fund was one of the most consistently performing within its strategy. Its net annualized returns over the past five years and since inception were around 7%.

I profiled Ramius last year. It was part of Cowen Capital, which managed nearly $15 billion in assets. But earlier this year, TD Bank closed on its purchase of the asset manager. According to sources inside the fund, the bank oddly decided to close down the fund due to the lack of investor interest.

Leibniz EMOTION (7th-ranked) returns will no longer be posted because a recent disclosure indicates the fund has been reporting “simulated” (re pro forma) numbers.

This was the first year I included this statistical arbitrage fund in the survey. I spoke with the manager. The fund reports to various reputable databases. It has a reasonable presentation document and DDQ, where the manager reveals an impressive professional pedigree. Early this year, With Intelligence published an article that clearly stated the Leibniz Group was managing more than $1.5 billion and the fund itself had been linked with many well-established asset managers, including Soros Fund Management and Schonfeld Strategic Advisors. And the manager was profiled in the Hedge Fund Journal, as one of the Fifty Rising Stars (Tomorrow’s Titans 2021 page 23).

I’m not questioning whether the performance numbers I cited were accurate. But what I’ve just learned made it unclear if they reflect actual investor returns. Footnotes in a recently seen Leibniz document state simulated numbers were mixed into the results.

As of this interview, Leibniz has not responded to my request for further clarity.

Bottom line: Both examples highlight the need for all potential investors to perform their own in depth due diligence before even considering investing. The value of this survey is to reveal a breadth of the most consistently performing managers. But I always emphasize my work is but a starting point to help narrow the search for funds that may be worth a deeper diver.

Thanks, Eric, this has been a really interesting discussion. A version of the quarterly report and main survey (not for commercial distribution) can be downloaded here.