Surging equity markets helped Hedge Funds to a positive November, bond rally caused headwinds for CTAs, Crypto Managers making a comeback.

Across our traditional alternative indices, we note that our Risk Parity and Risk Premia have printed the strongest numbers for the year. This is in part driven by the strong performance of the beta, but also the comeback of several option-related strategies (for instance the option writing CTA index is printing strong numbers).

The strong equity markets (US: 8.9%) helped to lift the average Hedge Fund to strong results. Equity Long/Short was one of the main beneficiaries of the rally and printed a positive return of 3.2%. One of the drivers of the equity rally was softer inflation numbers, which also resulted in a bond rally.

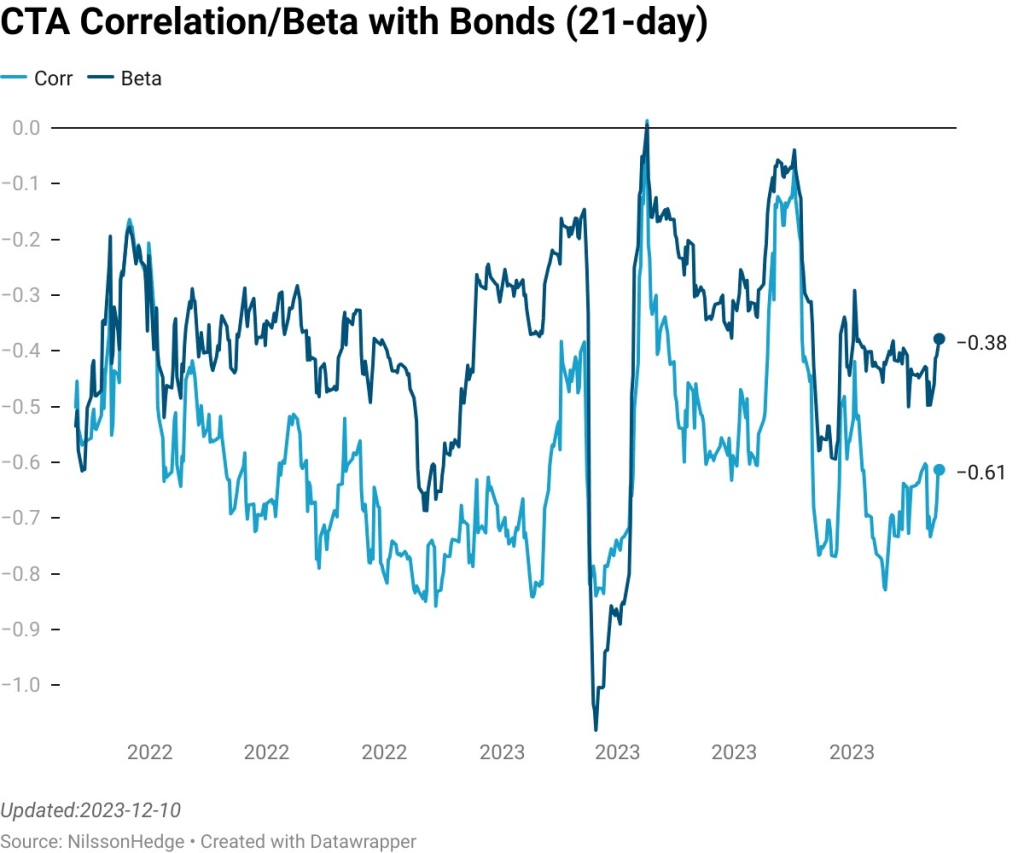

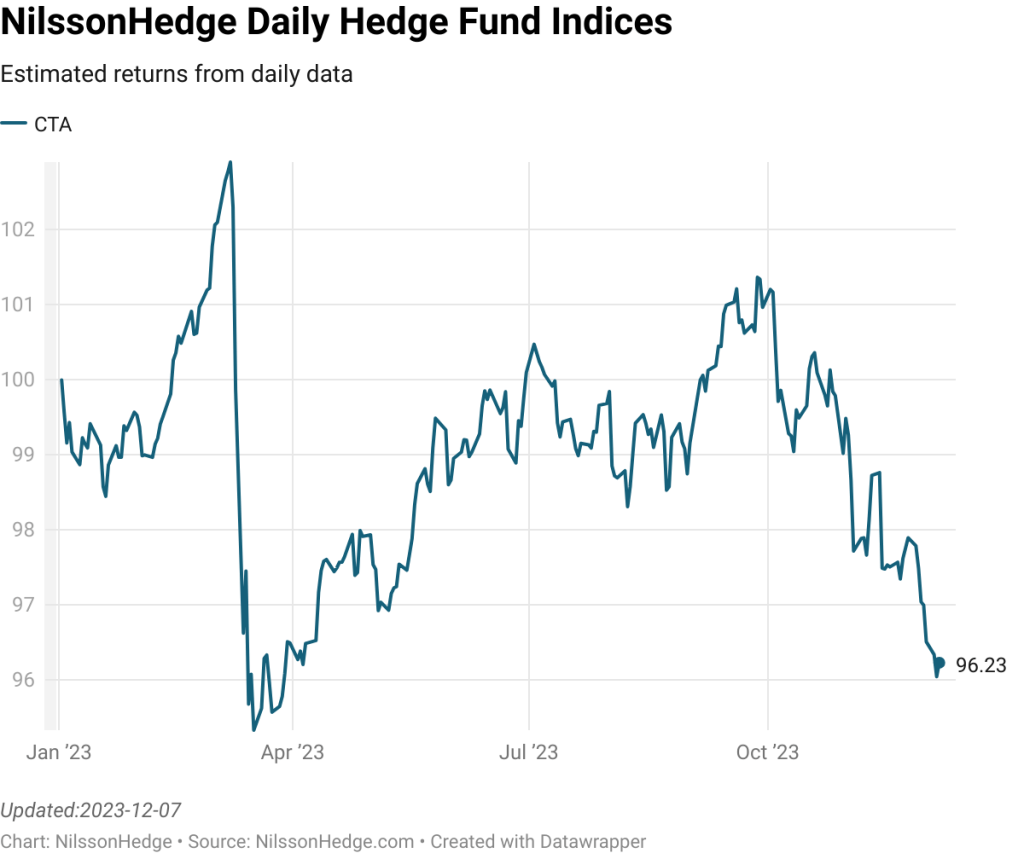

For CTAs, the action was much less favorable in November. Bond markets rallied, which caused short-ish positions for CTAs to incur losses. Our correlation monitoring still indicates a short position for CTA.

While the 4th quarter is usually strong for CTAs, this year, there has been a distinctive lack of trends in the last quarter and the trend seems to have continued into December.

On the Crypto manager side, we note that the impact of the Bitcoin rally has had a positive effect on directional Crypto Strategies, and while lagging behind the BTC, this is a strong comeback.

While some distance from its prior peak, the NilssonHedge Crypto Index has recorded a gain of 56% for 2023. But, the average manager is still in a 60% drawdown and needs to generate another 150% to bring back the index to the prior high. The math of drawdowns and high risk investing can be daunting at times.

Don’t forget to signup for our weekly updates.