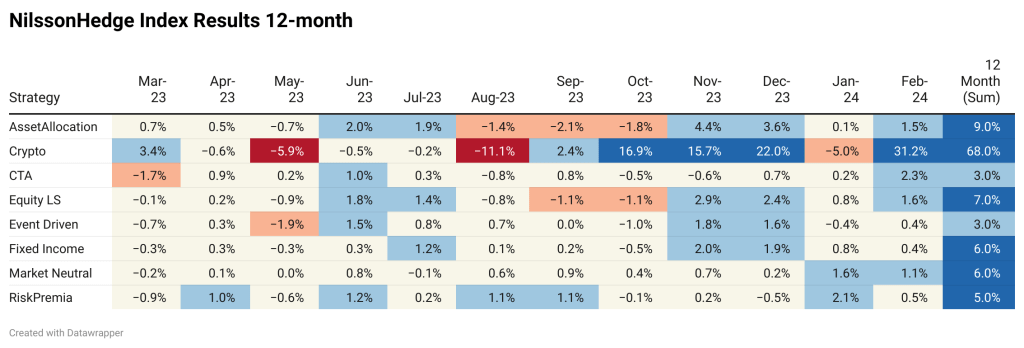

Occasionally it is useful to take one step back and look at longer data trends. Today, we do so, and look at what has happened over the last year using our index data. Except for Crypto Strategies (primarily buy and hold), we have seen reasonable stable results from several hedge fund strategies. Remember we are looking at averages, and specific managers will have results that are deviating from the average result.

CTAs and Event Driven Strategies have largely underperformed the index cohort with an average result of 3.0%. Traditional strategies range from Risk Premia (5%) to Equity Long Short (7.0%). Asset Allocation is a strategy group driven by long-only allocations to bonds and equities and has done in line with the rebounding markets.

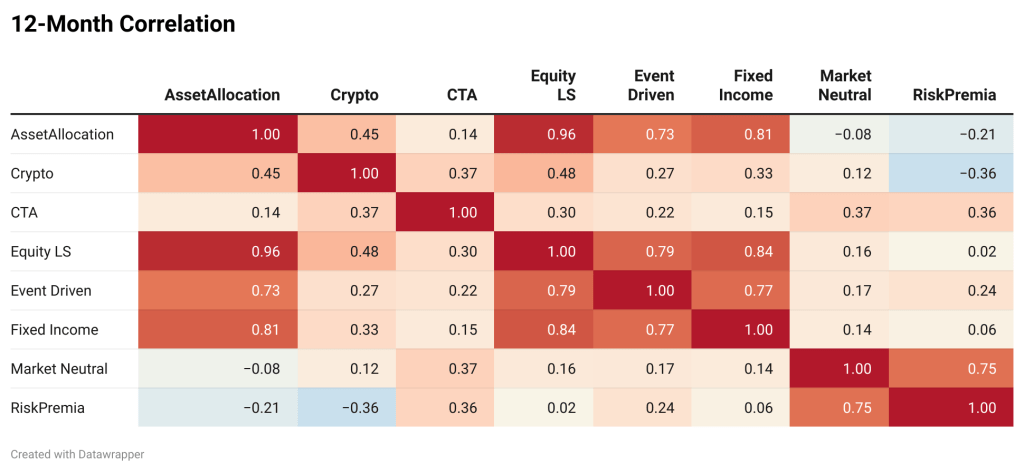

While this is a short horizon, it is noteworthy that Risk Premia strategies delivered the most uncorrelated results during the last 12 months. The strategy that was the most correlated to Risk Premia was (Equity) Market Neutral strategies. This suggests that market neutral factor did really well. Here we also see that these strategies managed to retain market neutrality with a low correlation to Equity and Fixed Income (Hedge Fund) strategies.

Crypto strategies, usually seen as a leveraged Nasdaq position, delivered strangely uncorrelated returns. Perhaps driven by the ETF launches that created their dynamic in terms of flow-driven price increases. This is not the norm that we have seen before. We have seen the beta of Crypto to Equities go from around 2.0 to essentially uncorrelated.

Despite some rather aggressive position shifts for CTAs, they had above-average correlation to other strategies and markets. This may be partly driven by the overall long-ish exposure to Equities. Bonds saw variable positions.

We have one or maybe two too many CTA indices, but they allow for a more detailed benchmarking exercise of a strategy group that is broader than what one thinks. We can see some distinctive patterns. The March-23 madness saw difficult markets for the broad trend managers (Systematic Momentum) but the group managed to print a small positive result for the 12 month period. The group that struggled the most was Discretionary Macro managers, followed by Systematic Commodity strategies.

Equity and Option strategies did the best and printed results of around 10% for the period. This is related to the relatively benign volatility picture that we have seen as of late. The prior stars in the Commodity markets, the Energy traders, had a lackluster period.

Our index is free and you can access it from https://nilssonhedge.com/my-account/free-data/.