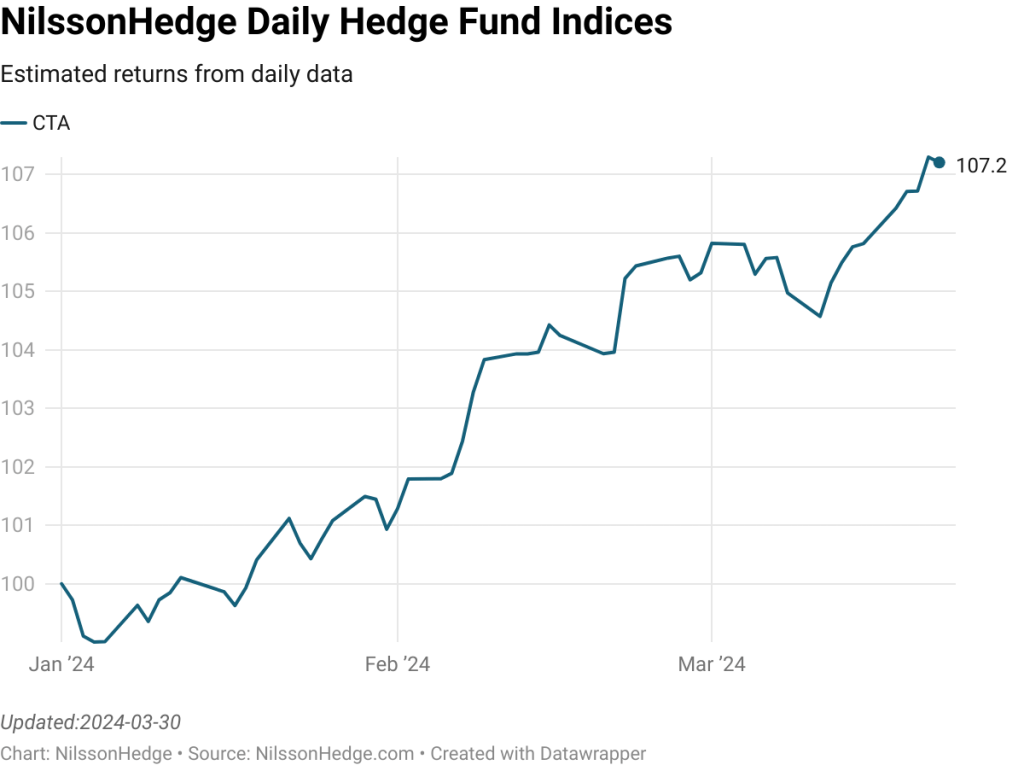

The first quarter of 2024 was a solid quarter for liquid alternatives. While few managers have reported their estimates for March, it looks like CTAs had a stellar quarter, with a 7.1% quarterly result leaving other strategies behind. While part of it is driven by equity market longs, a large part of it is also driven by Cocoa, the magnificent breakout out of 2024. A ton of Cocoa is now as expensive as a ton of Copper as the market is being squeezed higher, partly based on dire fundamentals but also based on technicals.

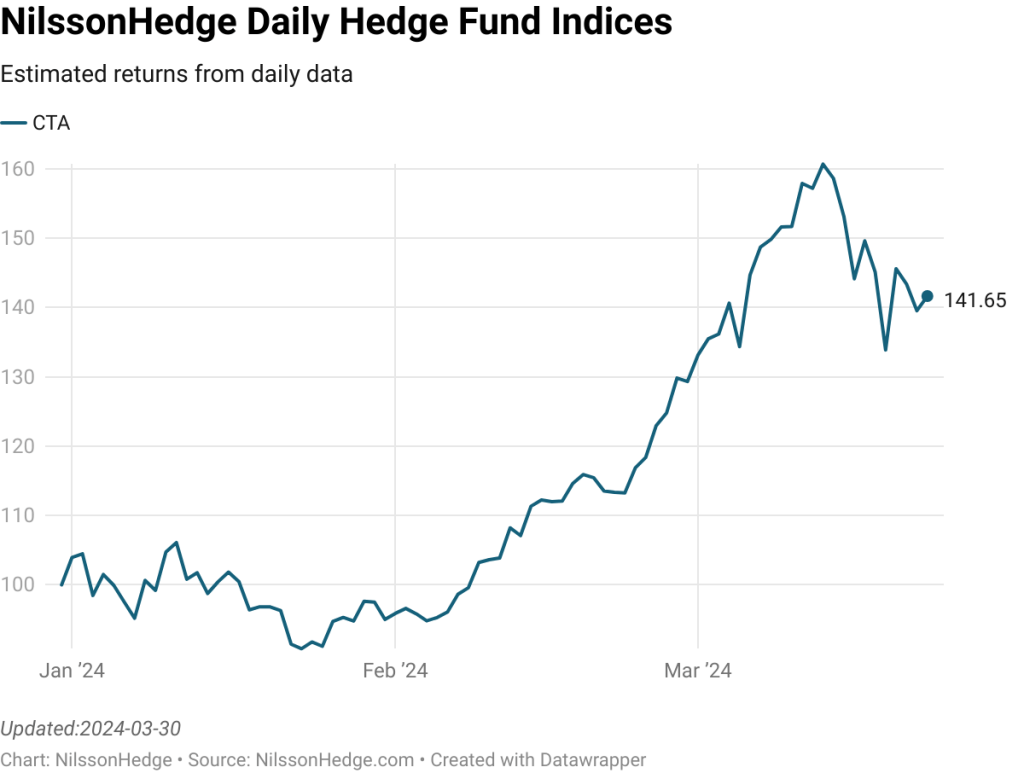

Crypto Managers (mainly Digital Asset Allocators) had a stellar quarter, although gave back some of the profits into the end of the quarter. This was the quarter when the Bitcoin ETFs really took off, combined with the rumor surrounding the potential approval or disapproval of ETH ETFs.

Equity Long/Short strategies continued to benefit from the strong equity market trends as the market discounted additional easing from the Federal Reserve and they climbed a wall of worry as several strategists predicted a pullback, that is yet to happen.

Market Neutral strategies continue to be a strong streak. Since June-23 we have yet to see a negative number. While the returns are not spectacular, the streak from a well diversified quant equity portfolio has been very stable.

While Event Driven strategies have lagged behind, we are now seeing a small pickup in activity.

A strong quarter for all of the liquid strategies that we track. Thanks for reading and please do not hesitate to reach out.