April continued to be an interesting month, from a macro perspective, with several interesting moves. We saw a significant streak of negative days in the equity markets, a depreciation of the JPY, and a mix of risk aversion and risk seeking behavior. We witnessed a somewhat well-advertised Iranian strike on Israel (in response to the killing of a senior revolutionary guard general), and a somewhat muted response. All in all, April brought a lot of unanticipated moves.

Post the Israeli response markets calmed down a bit and equity markets partially bounced back. The JPY depreciated at an increasing pace which triggered further opportunities for CTAs. Inflation continued to print higher numbers and the odds for a FED decrease any time soon are now rapidly being discounted out of the market pricing.

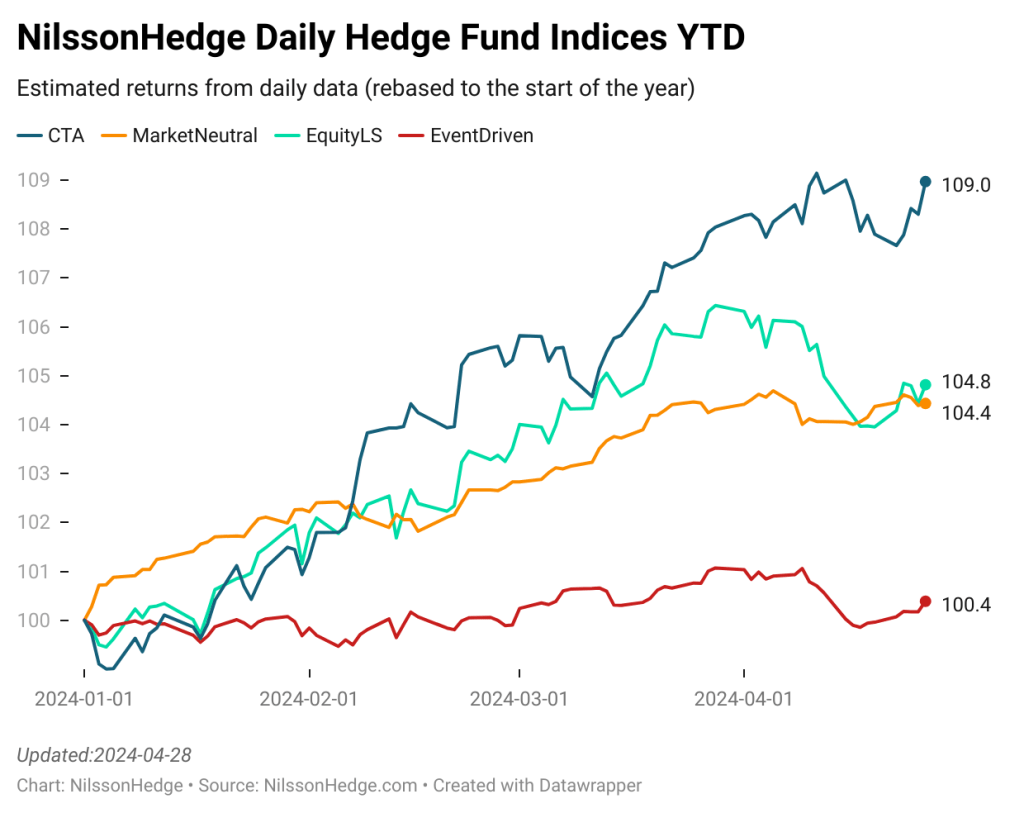

In terms of our daily performance barometers, CTA did well, although encountering slightly wobbly conditions mid month, they look to end the month higher. Equity sensitive strategies generally lost money on the back of a less than healthy equity market. Equity market neutral held up well.

In terms of CTA positions (derived from ETF) we see an increased exposure to Long USD (here shown as short exposures) provided good trading opportunities, long exposure to Energy paid off due to the increasing tensions in the Middle East. Base Metals performed well in light of a new restrictive delivery mechanism for the LME. All in all, a good opportunity for Trend Followers that made money in most sectors except for Equity. The darling of the last few months, Cocoa managed to avoid selling off, but seems to have lost a bit of momentum.

Interesting to see is that brief flirting with long positions in Bond Futures provided to be short lived.

In the next few months, NilssonHedge will have several interesting developments. Stay tuned, we are getting closer.