The start of August 2024 could have been a lot easier for systematic strategies (or most equity biased strategies) as equity markets took a deep dive on Monday, in combination with reversals in a lot of other popular trend trades.

But before digging into the numbers, I would like to invite you to a webinar that will be useful if you are trying to market your strategy and getting your strategy in front of investors. If you are a fund manager this is the webinar to join. A replay will be available.

Session 1: Thursday, August 22nd at 11 AM ET

Don Steinbrugge: Maximizing results from cap intro and webinar events.

Chris Addy: How not to fail at operational due diligence.

Matthias Knab: Getting visibility for your firm & strategy in a crowded market.

Session 2: Thursday, August 29th at 11 AM ET

Rebecca Meijlink: Succeeding in cross-border and cross-culture asset raising.

Paul Das: Institutionalizing your firm with painless IT systems and processes.

Linus Nilsson: Database marketing & how to pass allocator screens.

Click here to Register

As our readers are aware, we are maintaining a set of Daily Performance barometers, one for broader based CTA, with a focus on trend-following strategies. Currently, this index is down 4%+ for the month, which is on par with the micro banking crisis that we saw in 2023.

A great year has turned into a much more mediocre year for the strategy as we witnessed a large number of re-pricings, expectations changes for the US Presidential Election, sector rotations, and a modest hike from BOJ that may or may not have caused the Yen to strengthen. However, the backdrop is slightly different as the strategy has struggled since April to generate substantial returns. Here we also need to remember that Treasury Bills have generated 2-2.5% for any CTA that reports on a fund basis.

We see other indices showing roughly the same numbers, with the SG Trend Index down a bit more than 6% and the more diversified SG CTA Index down 4.5%.

If you started to trade mid-July and is flat ITD, and not using a (real) tail strategy, you are either very lucky or have found something that may provide some degree of protection. This does highlight that CTAs are also very unlikely to provide tail protection if they are long equities and short bonds into a market correction. This happened before and will happen again.

With the exception of Long/Short Equity, other strategies held up well. Market Neutral made money and Event Driven strategies only saw a minor correction.

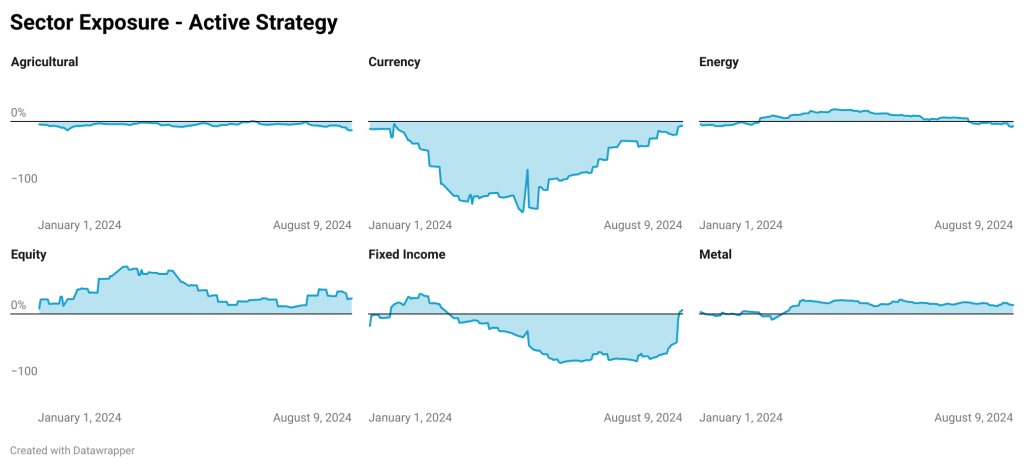

Throughout the crash on Monday, market pundits called that CTA would be forced to sell 100bn+ worth of equity exposure, simply due to increased risk exposure. A Bloomberg article called for more than 170bn worth of equity Futures to be sold, post the correction.

What is clear is that when volatility goes up, bet sizing usually gets smaller. For the ETFs that are tracking, this is yet to happen. They may not be using approaches that call for vol sizing (a hot debate) or they may use other types of risk management techniques, focusing on portfolio level volatility. Some reductions may already have been in risk parity funds, but those are likely only slowly being implemented.

The big change, which may not get the same headlines is that Fixe Income has switched back to a long position. From this point onward, CTAs are likely to be somewhat more tail protective than before.

Do not forget to join the webinar. NilssonHedge will do a minor presentation on how to ensure that allocators find you when they scan through their data sources.