AN ELECTION RALLY SENDS STOCKS TO NEW HIGHS IN THE SHADOW OF RISING UNCERTAINTY ABOUT WHAT’S TO COME

If you want to jump directly to the final update of the year of Global Investment Survey of hedge funds please click this link.

- Key takeaways from this quarter’s report

- Top-performing strategies in 2024 through September

- The market going into 2025—opportunities and risks

- November election and what it may mean for economies, markets, and hedge funds

- When a truly consistent fund manager suddenly fails

Hi Eric…a few things have happened since we last convened. But let’s start with what was the leading takeaway from this quarter’s report?

While the market has soared past its trailing three- and five-year annualized returns through 2023, the Top 50 is on pace to generate returns consistent with those two periods.

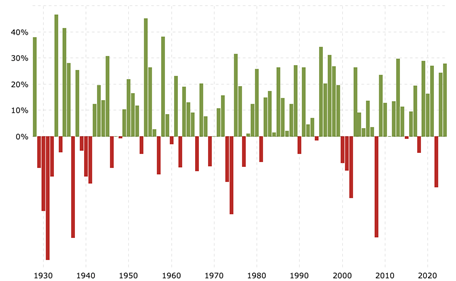

The S&P 500 TR was up more than 22% over the first nine months of the year, and that was before the rally that followed Trump’s win in November. If the market ends the year up 30%, which it may do, that would be twice its five-year annualized returns and three times its three-year returns. Historically, that kind of deviation is usually accompanied by a correction at some point.

(Since 1960, the last time the S&P delivered multiyear 20+% returns was right before the Tech Wreck.)

HIgher deviation was also evident in the average hedge fund performance, which was up 9.5% through September. Three-year annualized returns through 2023 were 3.4% and five-year returns was 6.30%. And the average correlation with the market over that long-period was 0.91.

When 2024 performance is included in that calculation, the average hedge fund will likely show even greater market correlation.

That’s the last thing LPs should want out of an alternative investment because it suggests a lack of independent investing which won’t provide much shelter when the rally falters.

The Top 50 was up 9.2%. That puts it on pace to track with its three- and five-year returns. This kind of consistency is the thesis behind the creation of the Top 50—not to deliver outsized gains but to find funds that remain steady through all kinds of economic and market conditions.

The Top 50 five-year correlation at the end of 2023 was a far more appealing 0.31, which this year’s performance will likely sustain.

Does anything else stand out? I have noted that you have a relatively large number of emerging market managers on your list.

Yes.

The second takeaway was the continued outperformance of the six emerging market managers who made this year’s survey—the most that ever qualified. The group’s 13.3% return made it the top-performing strategy in the Top 50.

Moreover, two of the four best performing funds YTD were EM: No. 33-ranked Sandglass Capital (EM credit) was up 24.2%; Top-ranked Peconic Grenadier (equity long/short) generated gains of 18.6%; 15th-ranked DE Shaw Oculus (macro) was up 16.1%; and 18th-ranked Enko Africa Debt (EM credit) rallied 15.9%.

Our recent EM webinar involving some of the top managers in the space, including the likes of Wellington Management and Cheyne Capital, highlighted this remarkable source of unexpected Alpha. And Bloomberg responded to our findings by publishing articles on two of our Top 50 EM managers.

Do you feel that the market will rally through the first half of 2025, bringing hedge funds along for the ride?

The safe answer is Yes, at least over the next quarter or two.

There is a great deal of enthusiasm driven by the Republican sweep of the elections and the sentiment that policies, from regulations to taxes, will be benefitting businesses.

The present trajectory of the economy has been remarkably steady and sustainable. Adding any kind of accelerant runs the chance of altering the balance between growth and declining inflation which has enabled the Fed to cut interest rates.

But Trump’s agenda is introducing a whole series of risks that may bring more uncertainty and volatility. It’s worth considering just four of his signature proposals.

The likely introduction of a broad range of tariffs introduces a new untested risk that most economists don’t favor and which will ultimately be paid for by end consumers. This means prices will rise.

Reducing regulations and market oversight may unleash M&A activity to boost share prices. But unconstrained deal-making will consolidate industry ownership, reducing competition, increasing pricing power and inflationary risks.

If US Government again ignores climate and environmental risks that are evident around the globe in order to stimulate more growth, then they these risks will intensify and cause environmental, economic and inflationary problems.

And there have been discussions about rolling back several of Biden’s major legislative accomplishments: infrastructure, chips and green energy initiatives. These are long-term financial commitments that benefit the entire country and may be providing the lift that has sustained growth while economists anticipated recession. Removing such important stimuli (much of which is essential) could be like proverbially pulling the rug out from under the economy.

So you’re worried about the next administration’s handling of the economy and impacts on markets?

Yes.

As mentioned, the US has been enjoying a remarkable balance between economic and job growth and declining inflation—something most pundits thought was impossible.

Our economy and market don’t need any additional hyping. But that’s what President Trump is bent on doing.

David Kelly, chief global strategist at J.P. Morgan Asset Management, thinks even partial implementation of Trump’s proposed policies, “would likely result in sharply-rising government debt and the potential, in some areas, for building economic and market risks.”

In such a scenario, he thinks “investors would be well advised to continue to rebalance portfolios both across asset classes and around the world.”

Anyone other prominent figures feeling cautious?

While Warren Buffett and Berkshire Hathaway haven’t chimed in about the post-election results and rally, it just may be that the firm was anticipating a sweeping Republican victory as many in finance were expecting it.

I have no clue if that factored into the firm’s decision to stockpile record cash of $325 billion. In doing so, the firm has clearly reduced its market exposure.

As David Einhorn recently told investors, Buffett has an uncanny ability to do what even he says can’t be done–time the market.

Einhorn recalls Buffett having closed his fund by the end of the 1960s, sidestepping the ensuing lost decade. He again sold “nearly everything” before the 1987 crash. And he was well positioned to exploit opportunities after the 2008 financial crisis.

For hedge fund managers and investors who are going all in with the rally, it may be worth noting what’s going on in Omaha.

While Europeans weren’t shocked that Trump won, the post-election autopsy seems to be faulting Democratic policies. Do you have any unique perspectives about why a close race didn’t end up that way?

Yes. There’s a disconnect between how well the economy is doing, soaring values of stocks and 401Ks, the remarkable legislative accomplishments of the Biden administration, and frustration voters expressed. We have never seen this before in modern American history.

I’ll highlight just two matters that I find hard to wrap my head around—both likely the result of the majority of Americans now getting their news from unvetted social media and walling themselves off from differing perspectives.

Blaming Biden for inflation is like blaming the weatherman for rain. It was a global phenomenon resulting from a cascade of events. His covid-induced American Rescue Plan was not the trigger. If it was, US inflation would’ve have been far greater than elsewhere and would not have fallen faster than any other developed economy has experienced.

Moreover, prices have risen not only due to higher costs but due to businesses finally seeing an opportunity to raise prices after years of not doing so.

Regardless of what any politician claims, the only way to bring prices down is through instigating deflation, which no one is advocating. And what the next president is proposing is likely to send prices even higher and threaten future rate cuts and growth.

The second issue: Trump’s victory canceled the import of January 6th and the need to render a legal accounting for one of the most shocking events in recent American history. And there’s more than a passing parallel to the same failure to have held bank executives accountable for the 2008 financial crisis and the risks that are still extant today.

A truly unusual event for the Top 50: one of them failed. What happened?

It was a volatility trader—14th-ranked Dynamic Alpha managed by Seattle-based Lattice Capital Management. After having enough years under its belt to qualify for the survey, it then made my short list for three straight years.

Since its launch in May 2016, the fund has been realizing consistent gains of 16% annually for more than 8 years. And it was doing so more impressively than most of its larger competitors by focusing exclusively on the S&P 500.

The fund was always clear about its Achilles Heel: Soaring short-term market volatility without a major market selloff. This didn’t seem likely. But markets can deviate from the logical.

That’s what happened in early August after the Japanese Central Bank nudged up interest rates by a mere 15 bps. Not long after, S&P volatility spiked above 65 and over several days the S&P lost 6%.

Option chain pricing of the S&P 500 broke down. The normal bid-ask spread of around $1 soared to an inexplicable $180 in pre-market trading on Monday August 5th. A contributing factor, according to a source familiar with options trading, was major market makers significantly pulled back, effectively reducing liquidity, hampering pricing and exaggerating the chaos.

The fund suddenly found itself down by more than 20%. Management, which has significant exposure to the fund, believed it was looking down a barrel of a gun. It thought trading disfunction was revealing cracks in the American economy that weren’t there.

Had it decided to ride out this very rough patch, according to a source familiar with the fund, Dynamic Alpha likely would’ve recovered and turned a profit in August, adding to its gains through July of 7-plus percent.

Instead, management decided to shut down the fund.

In doing so, it compounded existing losses, failing to benefit from the recovery that started just days later. By the time the fund had fully liquidated its positions, August losses cascaded to 40%.

There are basic parallels between LTCM and Dynamic Alpha: sound strategies that revealed problematic execution when an extreme condition hit.

LTCM failed not because of its underlying investments but because it didn’t keep enough unencumbered cash on hand to match its leverage and meet margin calls to enable it to ride out turbulence. For Dynamic Alpha, its strategy remained sound. But it apparently never gamed out what it should do in the event of extreme decoupling of the VIX and the market.

The key takeaway I see: if there is a weakness in any strategy, despite the remoteness of it happening, push managers to see if they have conceived a variety of robust responses—short of shutting down.

If a manager can’t answer such a core question, don’t invest because in case of a meltdown, you’ll never be able to divest in time.

Thanks Eric, always a pleasure to have you here. Please check out Eric’s latest report here