CTA – Did they really sell 130bn worth of equities?

Summary:

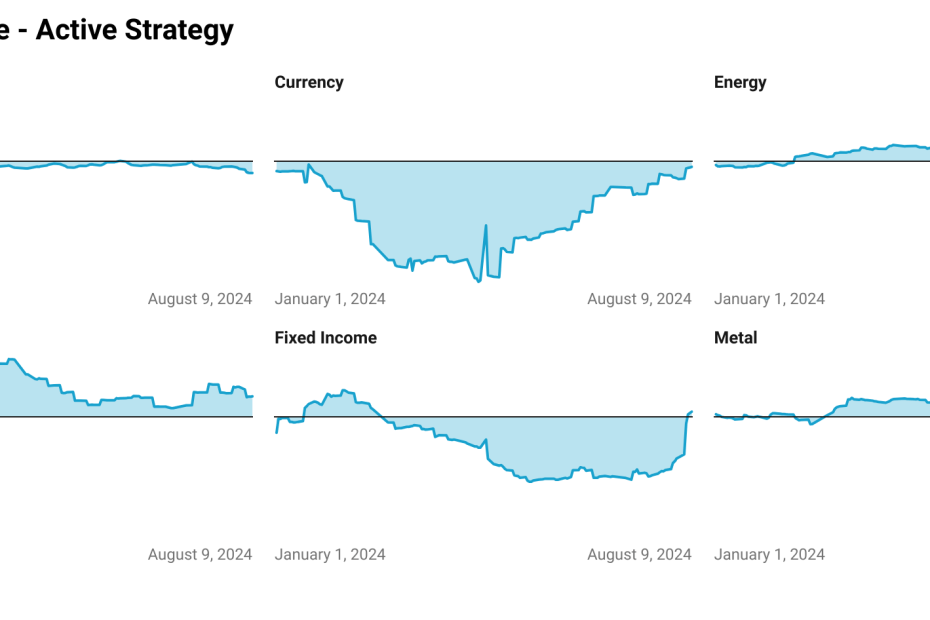

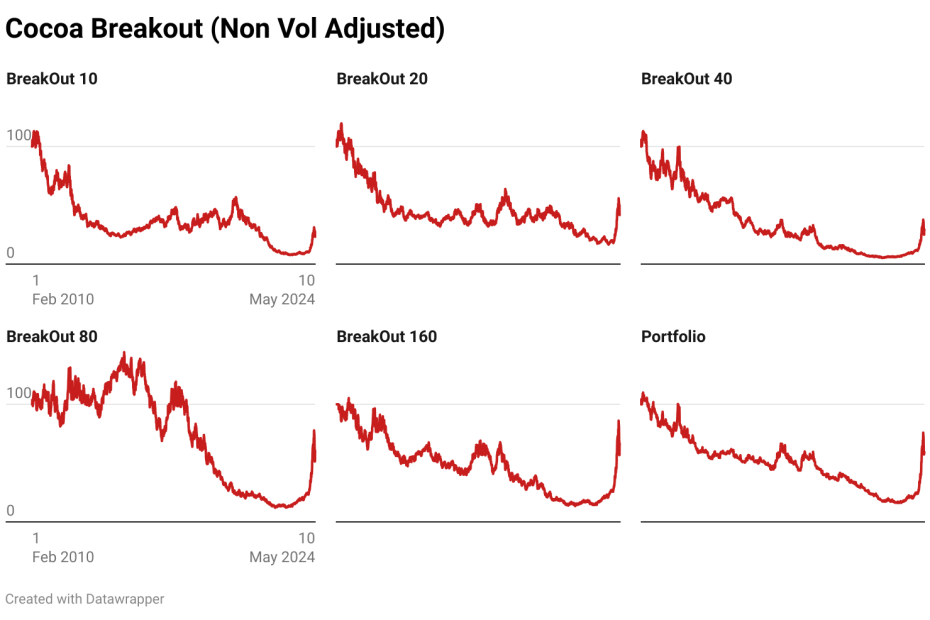

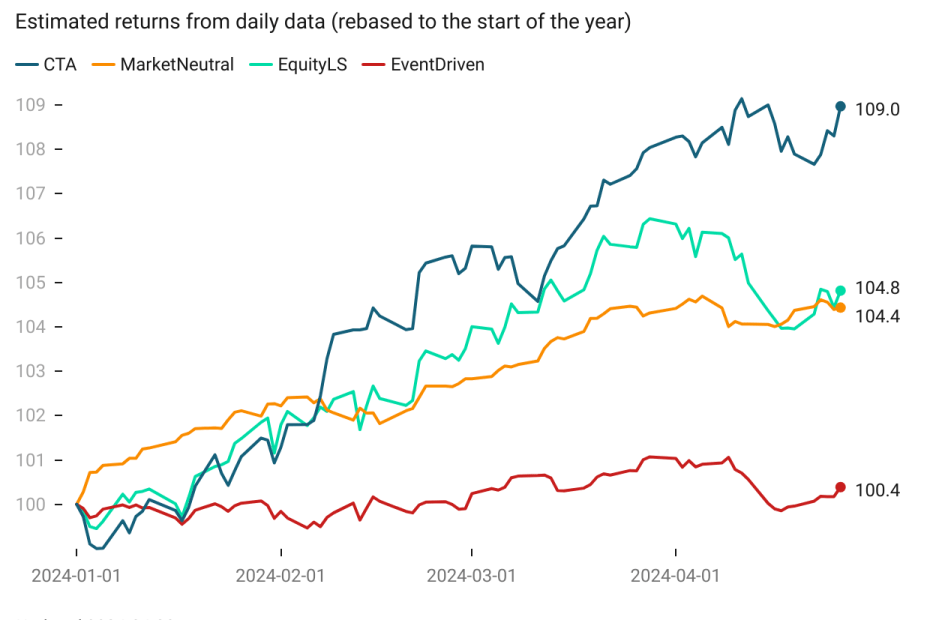

Equity markets took a dive at the start of August, affecting systematic strategies. A webinar is announced for marketing strategies to investors. Trend-following strategies face challenges and struggle to generate returns since April. Other strategies show varying performance. Increased volatility affects risk exposure and bet sizing. Fixed income shifts to a long position, potentially providing more tail protection.

You must be logged in to post a comment.