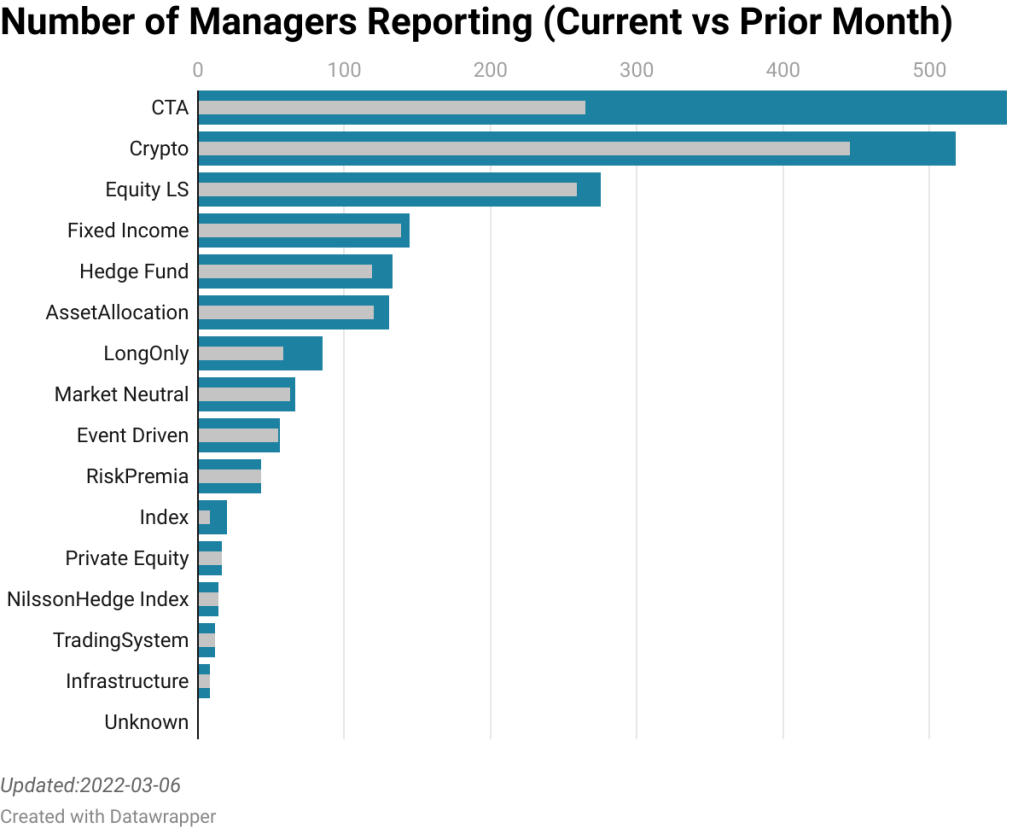

With some 1,600 strategies, we note that the events unfolding in Ukraine have had a limited impact on Hedge Funds returns. For February, we note that the largest spread of returns took place in Cryptos, but other strategies had a relatively low dispersion.

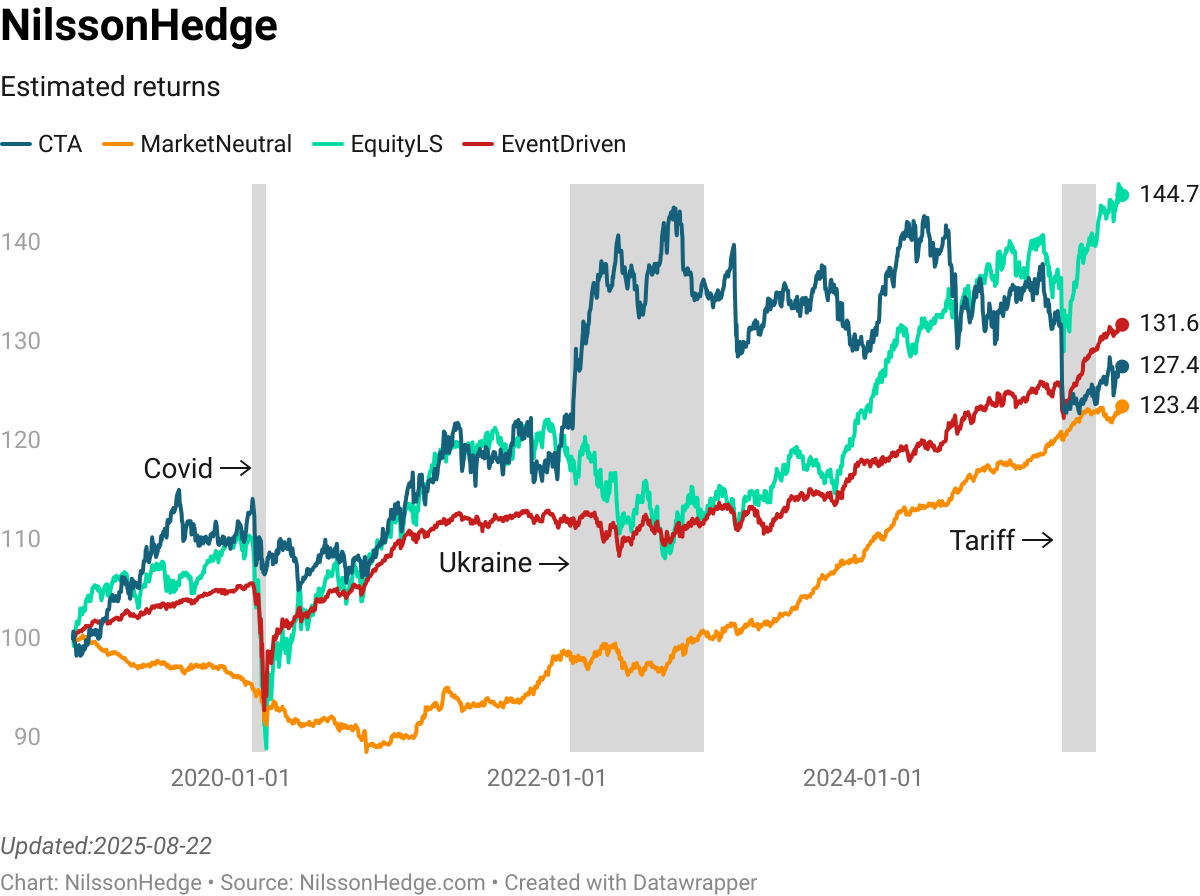

We also observe that since the inception of our Daily Indices, CTAs have now caught up with Equity Long/Short Strategies. Who would have believed that?

The estimated MTD performance for Hedge Funds (including Crypto Trading Strategies) is 3.0% taking the YTD number to -5.8%. The estimated MTD performance for Hedge Funds (excluding Crypto Trading Strategies) is -0.4% taking the YTD number to -1.1%. The estimated MTD performance for CTAs is 1.4% taking the YTD number to 1.0%.

We note that this is an estimate for reporting funds and that better-performing funds typically report early. These estimates do not include funds that have stopped reporting. For the survivorship adjusted number, we would like to direct you to the NilssonHedge indices.

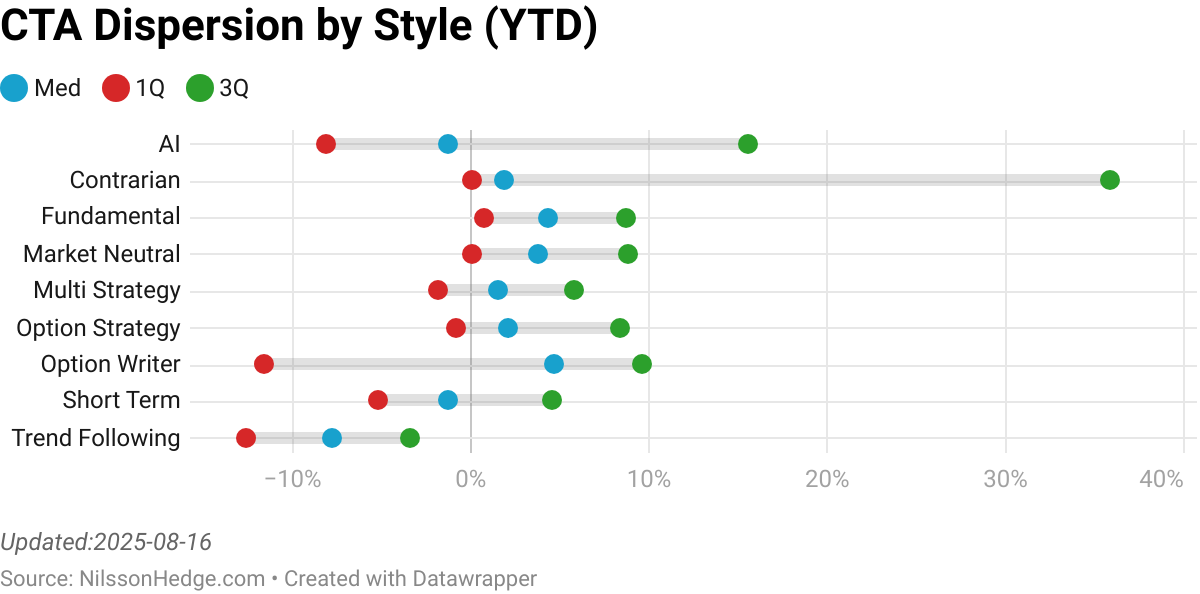

In terms of CTAs, it seems as if Trend Following traders are outperforming other styles. This is largely driven by Commodity Exposure.

Nilsson Hedge provides a free CTA/Managed Futures and Hedge Fund database. The vast majority of the database covers CTA or Managed Futures Managers, using a variety of styles and strategies. In addition, NilssonHedge offers supplemental coverage of a number of Long/Short Equity Managers, Fixed Income Strategy, and Multi-Strategy hedge funds.

Explore our free overview of Hedge Fund performance at https://nilssonhedge.com/reports/nilsson-report/

Sign up for the database here: https://nilssonhedge.com/database-info/databaseinfo/database/register-for-access-to-the-database/

The Database contains 2701 different managers, representing 4774 different investment strategies. For the current reporting month, 1627 managers have reported returns. For the prior month, we have 2078 live managers. In terms of CTAs, for the current reporting month, 265 CTA programs have reported returns. For the prior month, we have 553 live programs. In total, the database contains 31816 years of manager data. We cover 480 bn of Assets in the Hedge Fund space. Out of which 233 bn of Assets in CTA/Managed Futures managers.

Over the last three calendar months, we have added 100 new strategies to the database.

Database overview, including graveyard:

Number of CTA Strategies: 2575

Number of Equity Long-Short Strategies: 372

Number of Market Neutral Strategies: 116

Number of Event-Driven Strategies: 69

Number of Fixed Income Strategies: 181

Number of Crypto Strategies: 722

Number of Asset Allocation Strategies: 181

Number of Risk Premia Strategies: 65

To view estimates of current performance, our daily indices provide unique insights (https://nilssonhedge.com/index/daily-indices/)

This text is auto-generated and may contain mistakes. Past performance is not indicative of future results

NilssonHedge is a free resource, but we would appreciate a small donation that will be used to maintain the site.