We have recently collaborated with Marex Capital Introductions and Advisory, and we are pleased to provide you with our Contemporary Evaluation of Key Alternative Investments, attached below. Together with Dan Rizzuto, Head of Capital Introductions and Advisory we have considered CTAs, Risk Premia, and Hedge Funds in light of the unprecedented equity markets and an increasingly uncertain geopolitical environment. In the report, we observe:

- An increasing scarcity of diversifying investments relative to equity Beta

- Changes to Risk Premia as the sector has matured

- Negative skew across long-only and alternative strategies

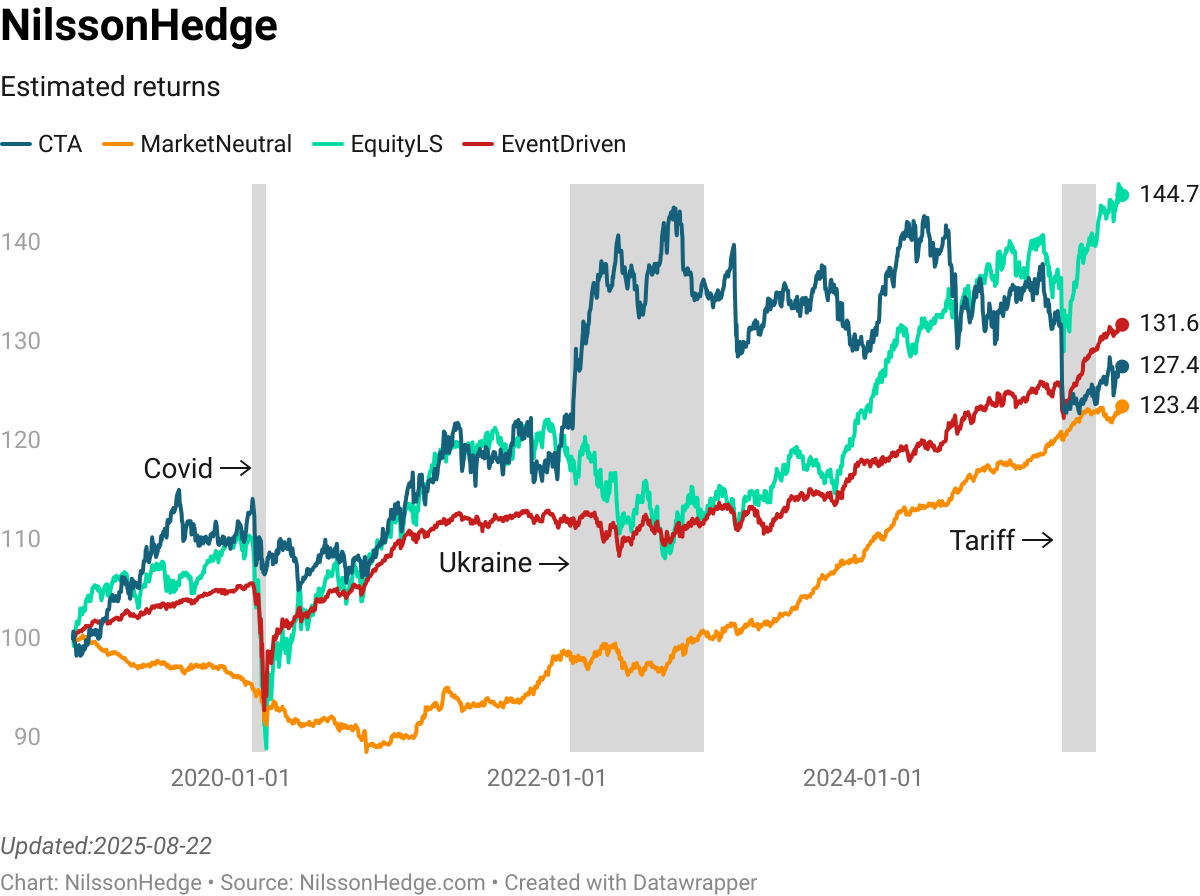

- CTA performance continues to contribute returns and diversification

- Strategy due diligence remains critical, in spite of, and because of, a persistent bullish equity environment

Inflation, central bank policy, technology, geopolitics all seem to be approaching greater levels of change or uncertainty. Historically, these have been environments where active management enjoyed disproportionate amounts of the resultant performance opportunities. We encourage you to review our findings and reach out with any questions and feedback. We look forward to hearing from you.

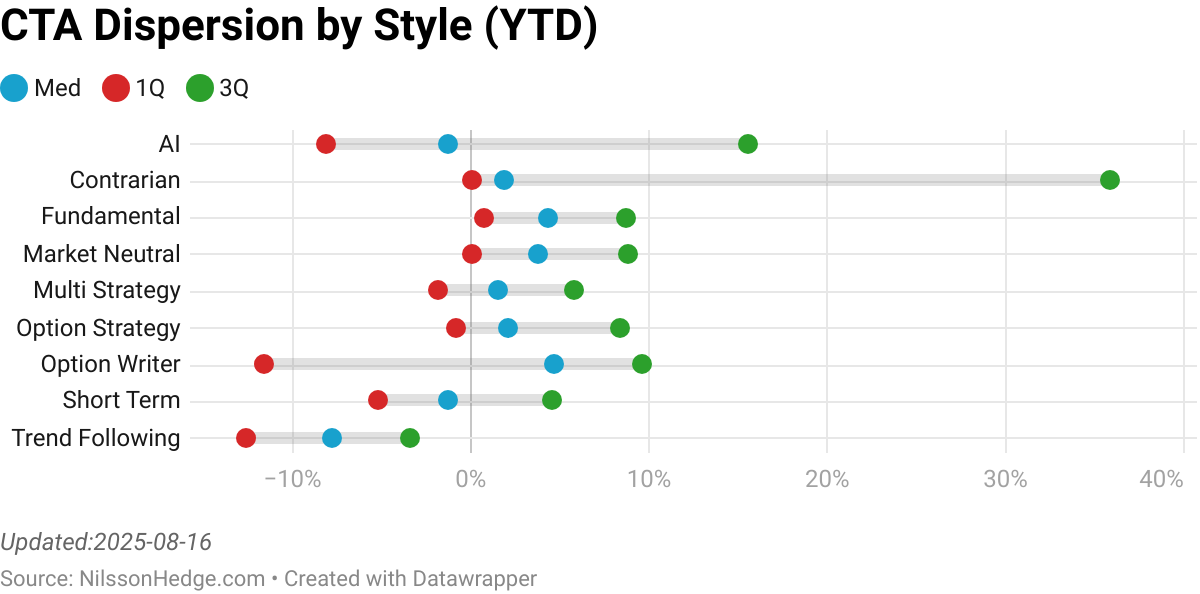

As part of our regular services, the database is updated and the estimated MTD performance for Hedge Funds (including Crypto Trading Strategies) is -1.2% taking the YTD number to 44.4%. The estimated MTD performance for Hedge Funds (excluding Crypto Trading Strategies) is -0.8% taking the YTD number to 5.9%.The estimated MTD performance for CTAs is -0.0% taking the YTD number to 6.4%.

We note that this is an estimate for reporting funds, and that better performing funds typically report early. These estimates do not include funds that have stopped reporting. For the survivorship adjusted number, we would like to direct you to the NilssonHedge indices at https://nilssonhedge.com/index/.

Explore our free overview of Hedge Fund performance at https://nilssonhedge.com/reports/nilsson-report/

Sign up for the database here: https://nilssonhedge.com/database-info/databaseinfo/database/register-for-access-to-the-database/

The Database contains 2490 different managers, representing 4470 different investment strategies. For the current reporting month, 1309 managers have reported returns. For the prior month, we have 2034 live managers. In terms of CTAs, for the current reporting month, 146 CTA programs have reported returns. For the prior month, we have 614 live programs.In total, the database contains 30410 years of manager data. We cover 466 bn of Assets in the Hedge Fund space. Out of which 230 bn of Assets in CTA/Managed Futures managers.

Over the last three calendar months, we have added 119 new strategies to the database.

Database overview, including graveyard:

Number of CTA Strategies: 2539

Number of Equity Long Short Strategies: 362

Number of Market Neutral Strategies: 114

Number of Event Driven Strategies: 63

Number of Fixed Income Strategies: 172

Number of Crypto Strategies: 543

Number of Asset Allocation Strategies: 179

Number of Risk Premia Strategies: 61

To view estimates of current performance, our daily indices provides unique insights (https://nilssonhedge.com/index/daily-indices/)

This text is auto-generated and may contain mistakes. Past performance is not indicative of future results