November looks to be a rather weak month for liquid alternative strategies with several strategies reporting negative numbers. On the positive side, we note that Crypto strategies, “pure” Commodity CTA, and Systematic Market Neutral strategies delivered positive returns. The result from Crypto strategies is barely positive, especially so given the inherent volatility of the asset class. On the negative side, Diversified (systematic) Managed Futures strategies had a weak month, and equity premia/stock picking strategies suffered (Equity L/S, Event-Driven, EMN Discretionary, credit-related Fixed Income) as well.

On a more positive note, most indices are positive for the year, with returns generally between 5-10% (with the clear exception of Digital Asset Manages).

NilssonHedge provides a set of Hedge Fund performance barometers, ranging from the traditional CTA indices to tracking novel strategies such as Crypto managers. Our indices are transparent and are formed at the beginning of each year, based on managers in the database at that particular point in time. They are not backfilled and give you an indication of the returns from a broad-based basket of Hedge Funds. We are currently producing 12 monthly different indices (including subindices). Following our prior process, we also launched two Market Neutral subindices in 2021, differentiating between discretionary and systematic strategies. In addition, we have five daily indices. You can find more info about the indices here.

Our main CTA index generated -1.4% for November and has delivered 4.6% YTD. In terms of the man-vs-machine battle, Systematic strategies delivered -1.8% (YTD: 4.5%) while Discretionary traders returned -0.0% (YTD: 5.2%). This is based on a representative sample of CTA managers. We claim that our CTA indices are the broadest performance barometers on the markets and offer extraordinary transparency when it comes to capturing the broader returns from Managed Futures managers.

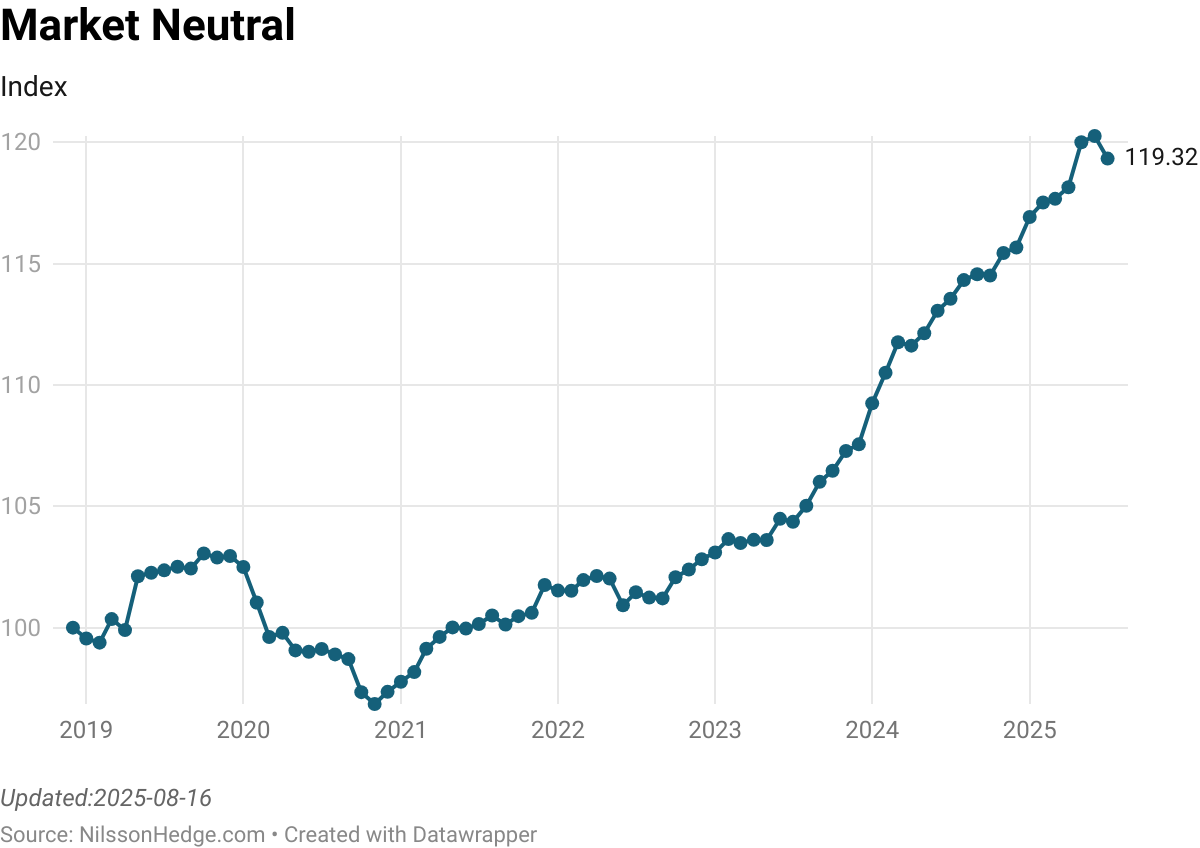

Taking the man-vs-machine battle further, Equity Market Neutral Strategies returned 0.1% for November, and have delivered 3.4% YTD. Systematic EMN strategies returned 0.6% (YTD: 4.9%) while Discretionary traders returned -0.3% (YTD: 1.8%). Given that most of these managers are UCITS managers, we are confident about the returns. EMN strategies are still striving to make a comeback from the difficult conditions in 2019/2020.

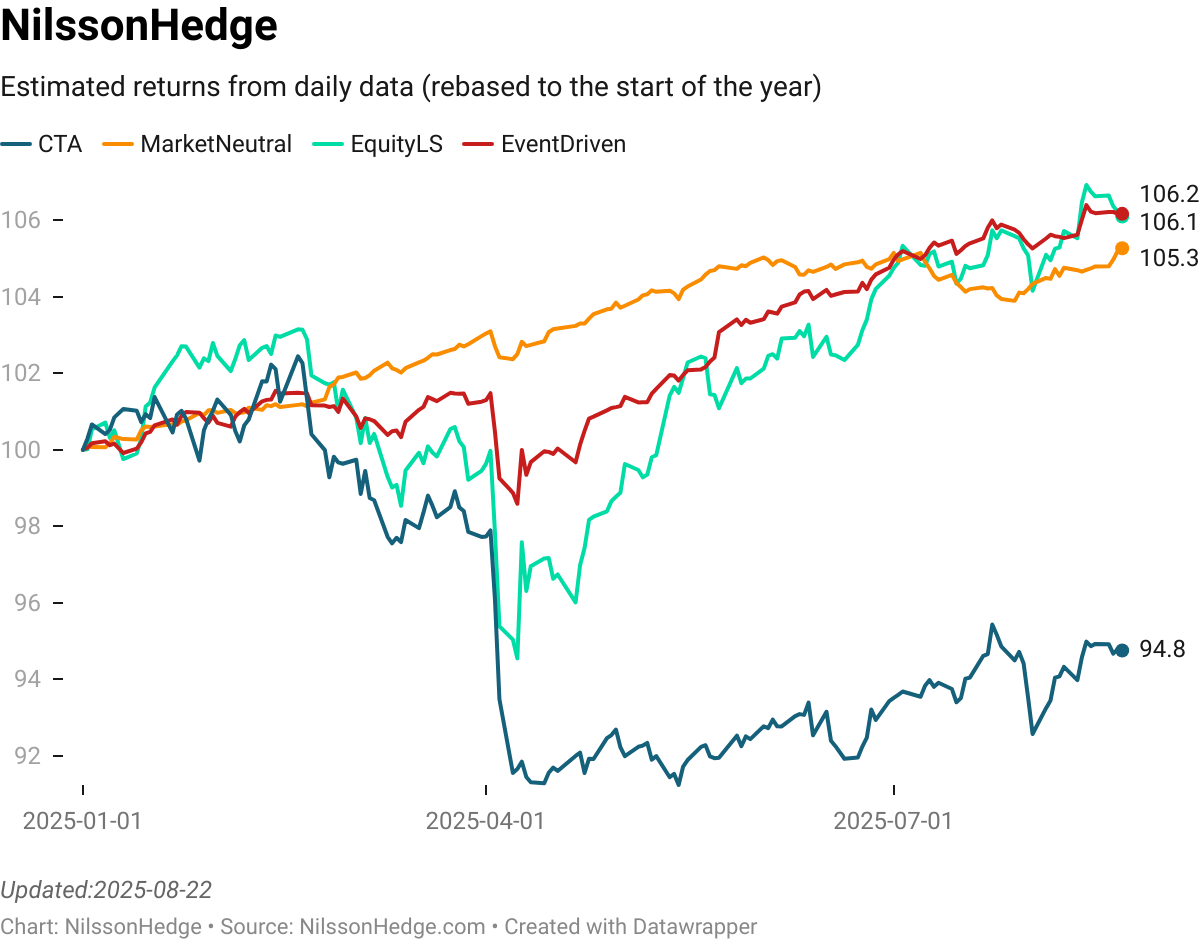

To view estimates of current performance, our daily indices provide unique insights (https://nilssonhedge.com/index/daily-indices/). These are set of daily hedge fund indices, covering CTAs, Market Neutral, Equity Long/Short, Event-Driven and Crypto managers. We typically deliver index estimates on T-1, making them the fastest indicator of hedge fund performance available. These indices help you to form a narrative, understand exposures, benchmark existing managers, and explain performance to clients.

This text is largely auto-generated and may contain mistakes. Past performance is not indicative of future results. NilssonHedge is a free resource, but we would appreciate a small donation that will be used to maintain the site.