The Cryptoverse is having its nth Lehman moment as FTX and Alameda Research are going into administration. The fallout of the event is uncertain we are still in the early days of the consequences, but it is apparent that much damage has been done.

This update will not speculate on the various activities undertaken (or not undertaken) by Sam Bankman-Fried (SBF). It will instead serve some real, non-speculative insights into movements by primarily sophisticated retail investors. To be noted is that we have seen few large Crypto Funds disclose any significant exposure to FTX. Galois Capital is the only Fund that has disclosed significant exposure, so far.

As readers of this newsletter are aware, we are providing a unique data source that gives us insight into the actual accounts and holdings of active retail traders (although they have become less active). One metric that we are tracking is the number of active accounts. This is a proxy for retail interest and activity, and while a lot of investors are presumably still shell-shocked from events, we have already seen a slight downtick in the number of active accounts.

The reduction is small with about 3% of the active users closing their accounts. This coincides with the event where Binance first extended a helping hand but only to quickly reach the conclusion that they would not pursue a purchase of FTX “as a result of corporate due diligence”. However, the more important trend here is that we are not seeing any pick-up in the aggregated activity. We are seeing a few new accounts here and there, but they are dwarfed by the entities that stop trading.

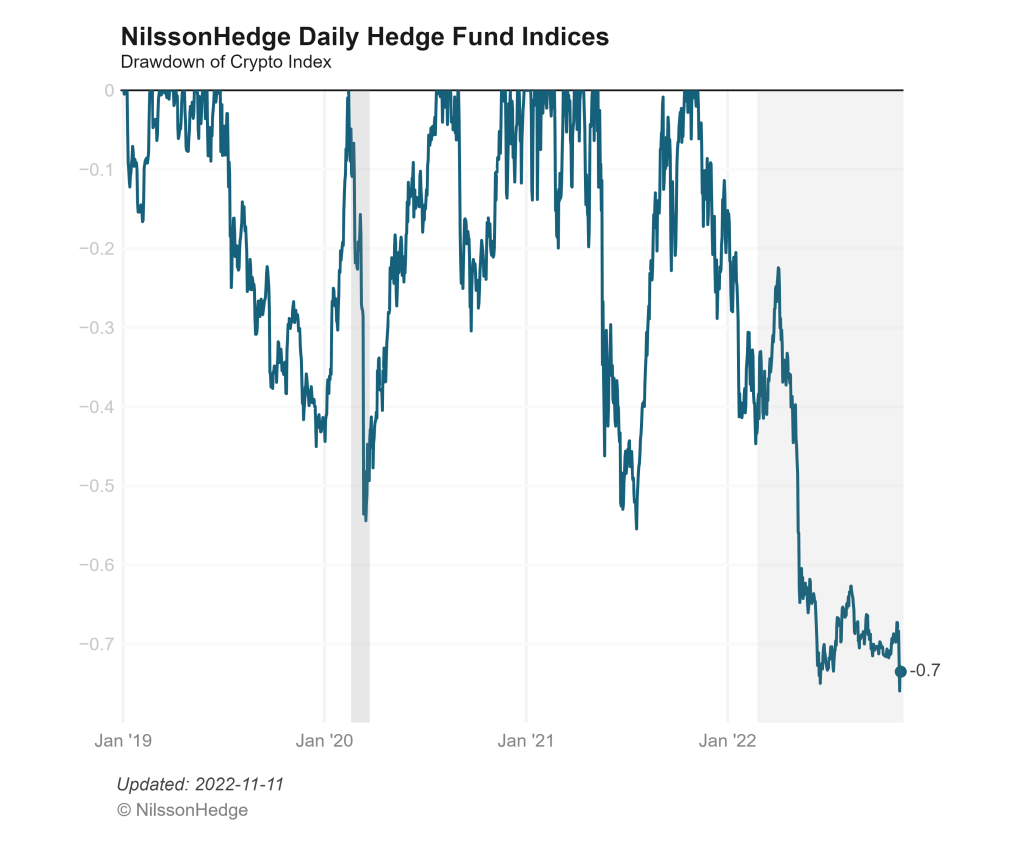

Our daily index, which is a contemporary indicator of how long-biases strategies are doing is down some 15% as of Friday for the month.

Given the volatility of the Crypto-markets. This is in itself not a remarkable result, but it is rather a way for us to remember that the definition of an asset that has declined 70% is something that has first gone down 50% and then lost another 40%.

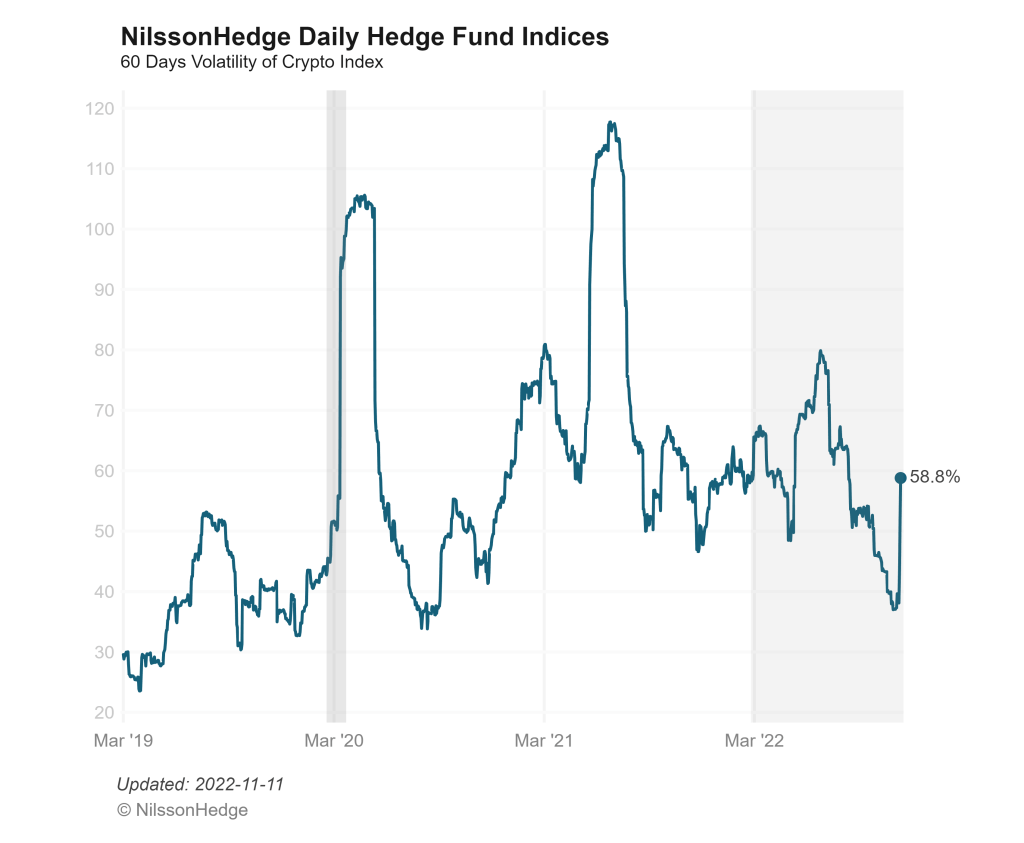

Cryptos are volatile, but recent market action is not an outlier. Volatility declined in recent months, presumably due to less trading activity (and fewer laser eyes), only to increase back into the 60% annualized range (on a 60-day rolling basis).

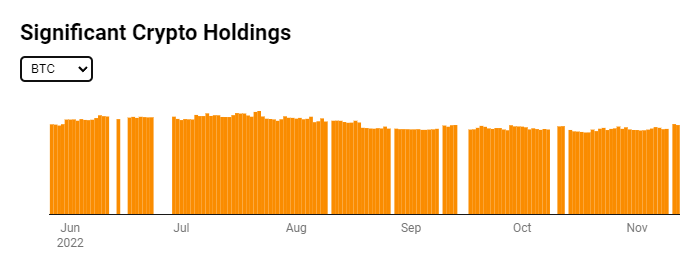

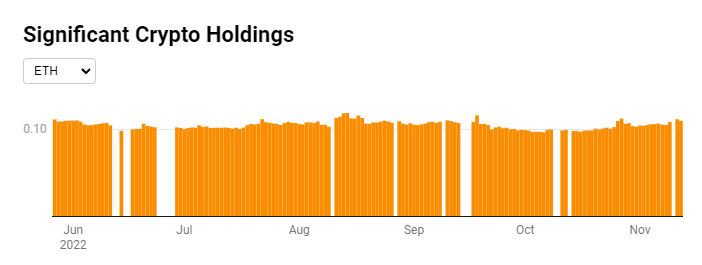

Using our position-based data source, we do note that there has been some tentative buy-the-dip behavior in BTC and ETH ahead of the crash. Most likely coinciding with the most recent inflation numbers and the expected less aggressive tightening.

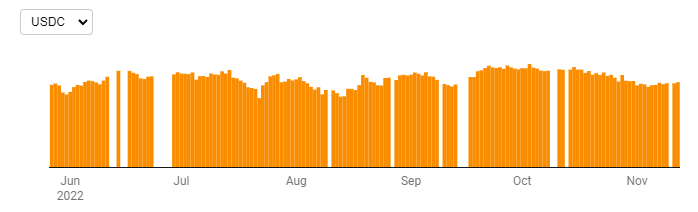

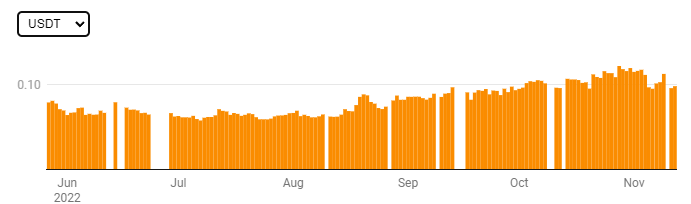

We have also seen lower holdings in USDC and USDT, the stablecoins that are available through our data source.

BNB, the Binance coin also popped up as a popular holding. You can access our index data here.