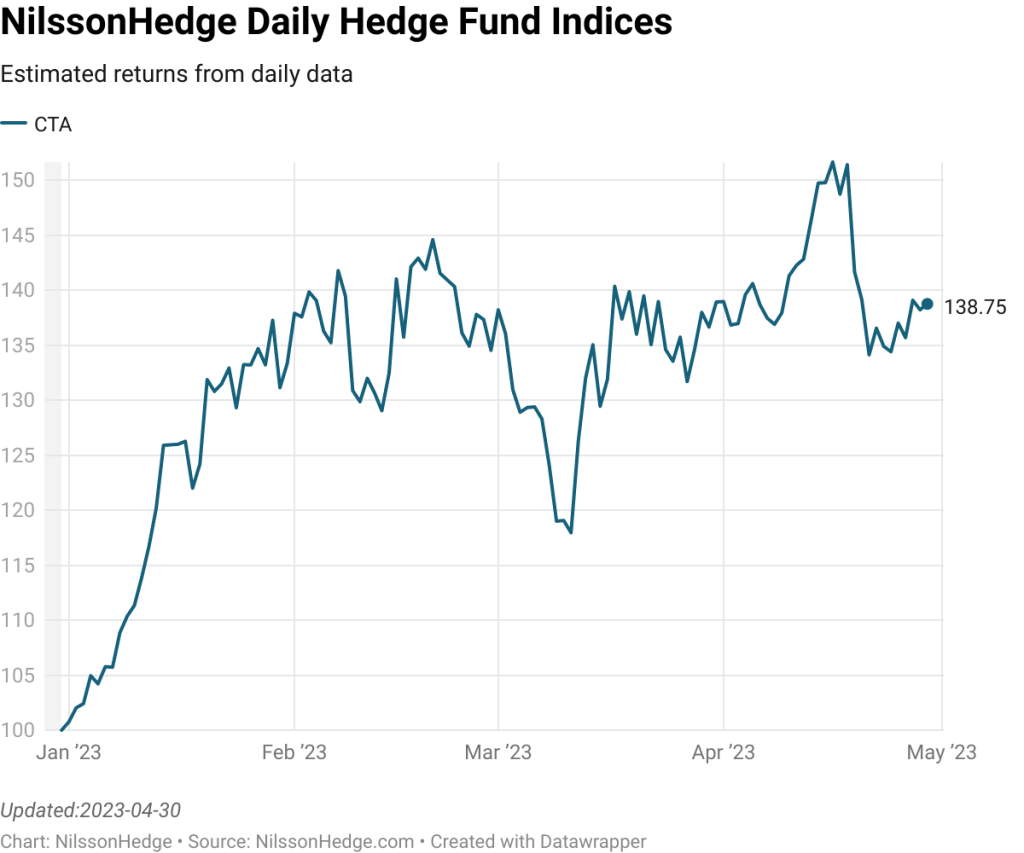

CTAs managed to claw back returns and returned 1.5% for April. This is approximately a third of the exceptional speedy drawdown in March and is a sign that some positions are still in place for CTAs. The NilssonHedge CTA index is still down 2.1% for the year.

While Crypto Strategies has done the best on a year-to-date basis, most of the initial hoorah was in the initial part of the year, as the market renormalized. After that, we have had some spurts of performance, but the index has largely whipsawed.

In the wake of a relatively quick banking crisis (with the recent news with regards to “First Republic” it can be argued that it is still ongoing), Equity Long/Short strategies have benefited from the positive drift in equities. Event and Market Neutral have remained somewhat related but are slightly positive for the year.

In terms of exposure, and while imperfect compared to running actual models, it gives a general indication of what changed after the Trend-Following reversal in March. Equity positions have remained largely intact and short bond positions have been squared.

We also note that the USD debasement trade has picked up steam, as CTAs are generally short the USD against a basket of currencies. Up until last year, this was generally a long position. In other sectors, we do not see a high correlation. Here, it can be observed that correlation during reversal may tell us more about the tendency for markets to behave in one way rather than telling us a lot of individual exposures.

Next week, we expect to have a slew of return estimates for April. Stay tuned. To get the email directly in your inbox, feel free to subscribe to our weekly updates.