We should have done this long ago, improving the granularity of our Crypto Hedge Fund Indices and our classification for those managers.

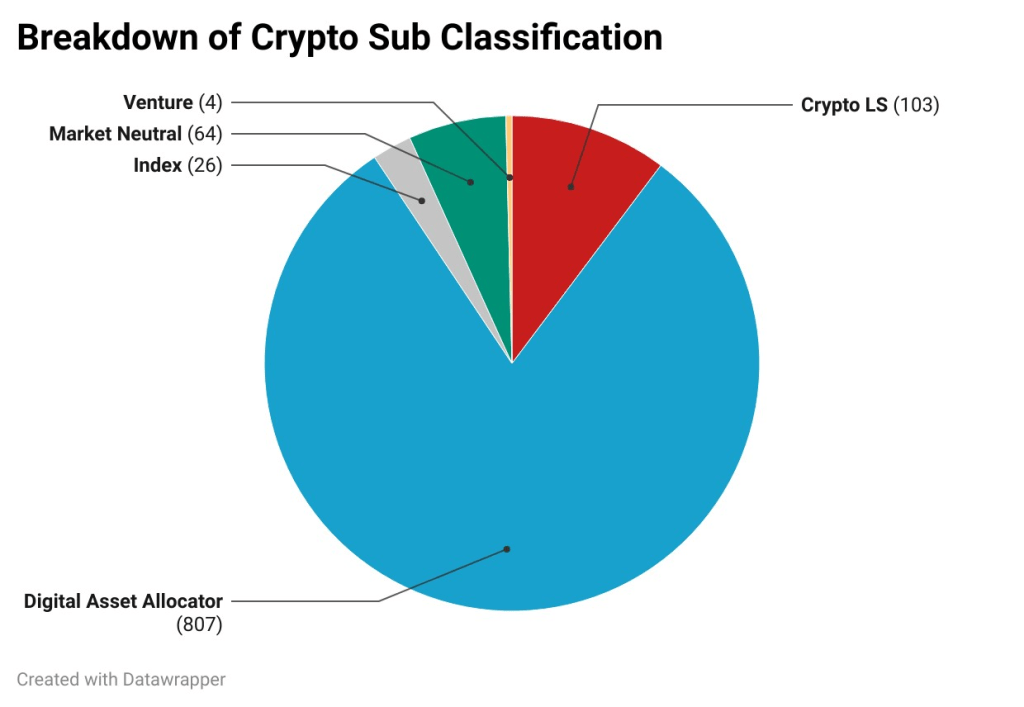

The goal of this exercise is to be able to better benchmark and compare managers within this nascent space. We have thus split the Crypto-verse into four different sub-classifications:

- Digital Asset Allocator – The equivalent of the Asset Allocator, trying to find the Coins offering the best “long-only” portfolio. They are expected to be structurally correlated to the various long-only indices available and have a similar level of volatility. Occasionally they may include stable coins if the outlooks is considerably bearish. Given the history of Digital Assets, this is the largest group.

- Crypto Long/Short – The equivalent of the Equity Long/Short Strategies, managers that are partially trying to hedge exposure, while having a significant correlation to Digital Assets. This category does to some extent overlap with the Digital Asset Allocator group.

- Market Neutral – DeFi Yield and Basis Trading strategies end up in the category. Statistical arbitrage strategies cross-trading several coins based on mathematical relationships also end up here. High-frequency trading with modest correlation will also end up in this classification. This is generally the group that is growing the fastest

- Index – Strategies that are established to provide close to 1-1 correlation with one of the digital Tokens. These are typically ETF-like structures (yes, they exist outside the US).

There is also a smaller Venture category, but this is too small to be noteworthy, as most of our managers are focused on (mostly) liquid coins.

As this group is established post-hoc, we have applied statistical filters, language models, and “common sense” to establish the groups. There may be mistakes and we will gradually sort them out as we apply further checks.

To judge the pace and development of each sub-group we study the number of unique data points. As we are interested in the growth pace, we use logarithmic graphs. Here we note the acceleration of the Digital Asset Allocator group throughout 2021, which has now slowed down considerably. Long/Short and Market Neutral strategies are growing at a fairly steady pace.

We have also created three additional Crypto Indices, which are available through the Member Library. Shortly, we will add these sub-indices to our index page and you can view them in parallel to our regular Crypto Index.

The broad Crypto index and the more specific Digital Asset Allocator have large similarities. The Crypto Long Short has lower volatility but is dependent on the beta. The Market Neutral Index has little beta. The impact of FTX can be seen.

The classification is available to our database subscribers.