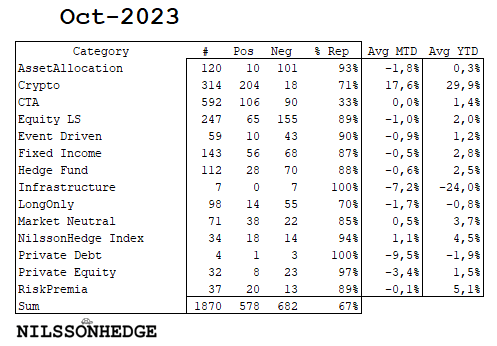

Based on data from more than 1,200 funds, October was a weak month for the hedge fund industry. The exceptions are Crypto Managers and Equity Market Neutral which produced gains. Crypto Managers are still generally lagging behind BitCoin. Continue to explore our free resources to understand Hedge Fund strategy performance.

- Trend Following CTAs lost on average. The NilssonHedge Daily CTA index ended October down 1.5% and is now marginally negative for the year.

- Large Equity Market Neutral managers managed to deliver positive returns. The NilssonHedge Equity Market Neutral index posted a gain of 0.8% in October. The index is up close to 6% for the year.

- Crypto Managers came back to life with a double digit gain. Our Daily Crypto Index record a gain of 14% for the month. Our broader monthly index which also includes strategies reporting monthly recorded 17%.

CTA

CTAs likely benefitted from short positions in Fixed Income and Equities, but generally lost in Commodities that produced whipsaw losses. Short-ish exposure to bonds has been a mainstay allocation for CTAs over the year. Equities have been a somewhat more variable allocation. Indicative exposure can be analyzed using our Correlation Tracker.

Crypto Strategies

For Crypto Managers, there is a stark contrast between the BTC and the so-called AltCoins. According to an analysis done by Runa Digital Assets, at the end of Q3-2023, only 6% of the AltCoins have outperformed BitCoin in the current cycle.

The effect of this is that most Crypto Managers have failed to deliver results on par with BTC. They typically hold more diversified portfolios. In prior bull market cycles AltCoins has generally produced positive returns. In this cycle AltCoins are negative. This is somewhat similar to the issues suffered by Large Cap Equity Managers who seem to struggle when only a few companies provide the bulk of the returns.

Equity Market Neutral

EMN strategies tend to do better in higher interest rate environments, but we have also seen dispersion increase across equity market sectors. This tends to be beneficial to managers engaging in Value and Momentum factors as there is a larger divergence between companies with good or bad fundamentals.

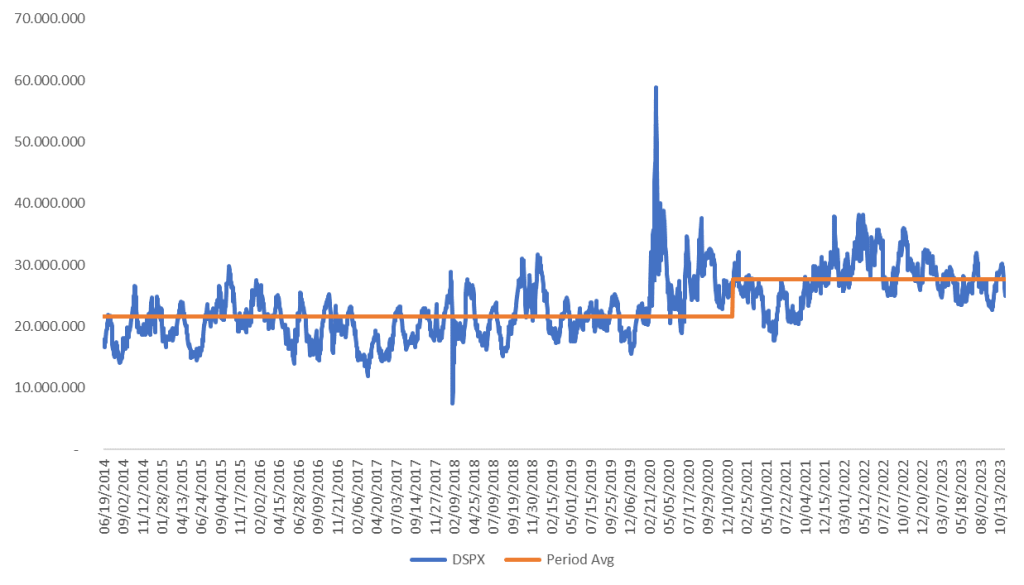

Using historical data for the recently launched Cboe S&P 500 Dispersion Index, we note that the average dispersion has shifted higher post-Covid, especially after the FED started to increase rates. This is believed to be a contributing factor to strong Equity Market Neutral performance.

If you have a few minutes to spare, feel free to watch my conversation with the duo (Rich and Simon) behind the Algorithmic Advantage.

Please join our weekly mailing list and do not hesitate to reach out to us if we can help you with data and analytics.