Due to the rapid increase in the Risk-Free rate, there has been an increased focus on the so-called Hurdle Rate, the rate of return required before a manager can start to collect performance fees. A large number of investors has started to ask if the increased risk-free interest rates should have implications on the minimum required returns.

As the Fed Fund rate has increased, generating 5% per year becomes a rather uncomplicated task and does not require “skill”. In this short post, we explore the implications for various strategies and how we think about the issue.

BNP’s Capital Introduction Team recently published a report on expectations in a high-interest rate environment. Among other things, they covered the increasing demand for a hurdle rate to be implemented in fee agreements. Not surprisingly, they find that 90% of the investor believe that Hurdle Rate should be in line with the Risk Free/Market Beta, while only half of the managers agree with the statement.

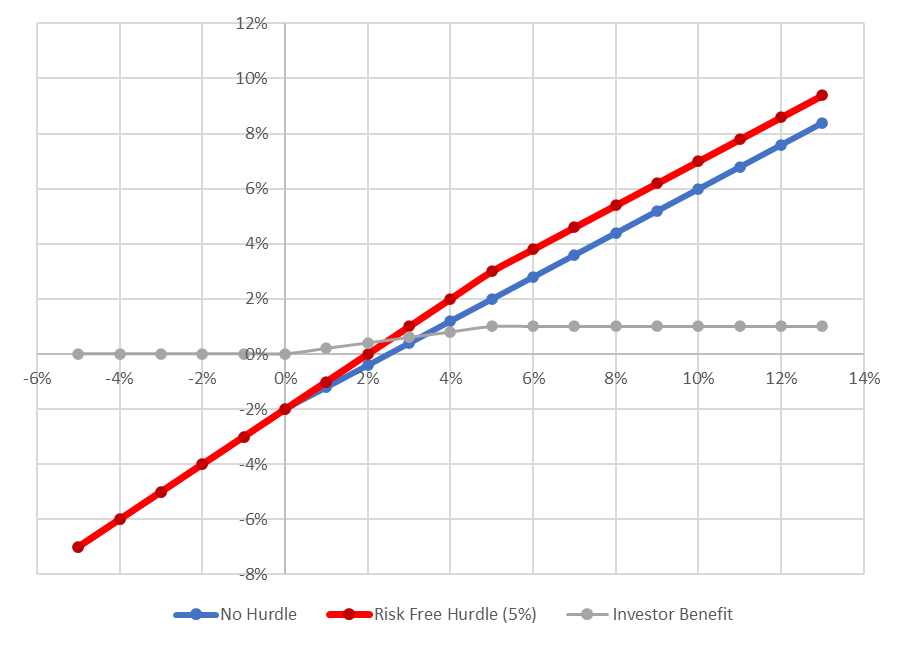

A Hurdle Rate is, ceteris paribus, beneficial to the investor. As seen in the chart, a hurdle rate of 5% (current risk free interest rate) gives the investor an additional return benefit of 1% if the return is above the hurdle. Conversely it is detrimental to the economics of the Hedge Fund manager. Here we cheeckishly assumed that the performance fee is calculated before the deduction of management fees.

Without a Hurdle Rate, an unethical manager could simply go to cash, and generate 5% gross returns which translates into a 5%-2%(management fee)-20%(5%-2%)(performance fee) = 2% net return. While not a sustainable business model, the hurdle should incentivize the manager to take risks.

Even without a hurdle rate, 3% net should not be viewed as a strong result from an absolute return perspective but is a nice carry for a manager struggling to find alpha. This should be kept in mind when evaluating funds. For managed accounts or leveraged strategies, it is slightly more complicated.

As anything else, the devil is in the details. The Hurdle rate should be a function of the unskilled investment opportunity. For managers that are correlated to market beta, the right hurdle is probably the beta based return. As an example, for an Equity Long/Short Manager, the hurdle is probably the long-term market equity beta of the manager, which typically is around 0.5.

For CTA funds, the risk free rate of return simply lifts the expected return of the fund. For an example of this, have a look at how many of the Managed Futures ETFs are structured. Futures positions alongside a healthy holding of T-Bills. The Simply Managed Futures ETF illustrates this nicely, 90% of the fund is in T-bills. Most FCMs allows you to deposit Treasury Bills as colleteral for initial margin.

For Managed Accounts, which often are partially funded, only the allocated cash should count towards the Hurdle. To make it easier, you could write your fee arrangement based on Excess Returns and allocate the interest rate earning to a separate account. We note that the earned interest rate also require adjustment to performance ratios.

Summing it up, the Hurdle Rates are beneficial the investor. As the risk free rate is higher, funds should adopt hurdles that are in line with the current market climate. The larger the investment is, the easier it will be to agree on customized terms.